Woolworths Group (ASX:WOW) Shareholders Have Enjoyed A 64% Share Price Gain

By buying an index fund, you can roughly match the market return with ease. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, the Woolworths Group Limited (ASX:WOW) share price is up 64% in the last three years, clearly besting the market return of around 20% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 38% , including dividends .

See our latest analysis for Woolworths Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last three years, Woolworths Group failed to grow earnings per share, which fell 8.3% (annualized).

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

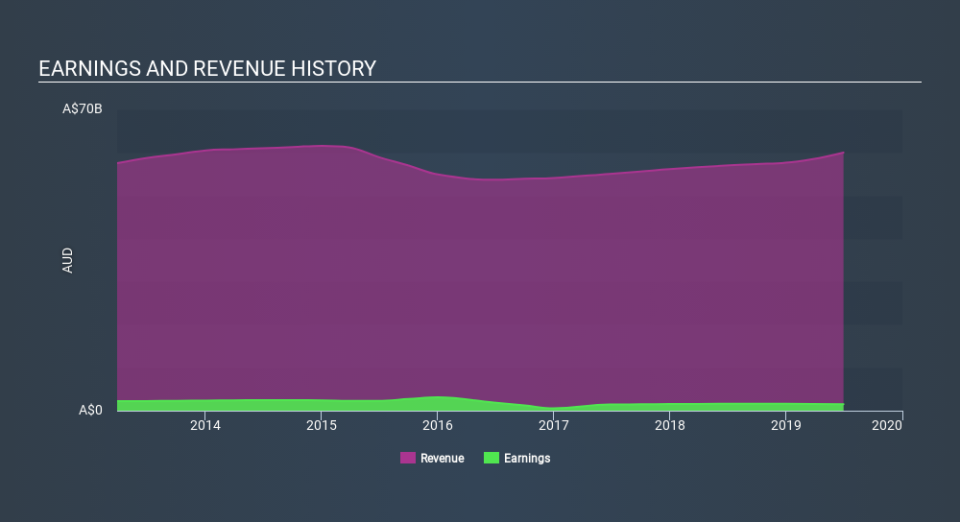

It could be that the revenue growth of 3.5% per year is viewed as evidence that Woolworths Group is growing. If the company is being managed for the long term good, today's shareholders might be right to hold on.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Woolworths Group is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Woolworths Group's TSR for the last 3 years was 81%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Woolworths Group shareholders have received a total shareholder return of 38% over one year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 8.9%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Woolworths Group better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Woolworths Group .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.