House prices down, but no crash: What's going on with Aussie property?

What is it about Australian house prices?

Even with a one in 100 global health pandemic and the deepest economic slump since the 1930s Great Depression, house prices are just ticking down – not collapsing, crashing or plummeting as the house price gloomsters would like to think.

According to the Australian Bureau of Statistics, house prices fell 1.8 per cent in the June quarter follow a rise of 1.6 per cent in the March quarter but were still up 6.2 per cent from the level of a year earlier.

Using the more up-to-date Corelogic data, house prices have eased a little more so far in the September quarter but the falls are marginal.

The Corelogic data shows the so-called 5 cities series is down 1.5 per cent in the September quarter to date, with the largest falls – unsurprisingly – in Melbourne which has dropped 2.8 per cent and Sydney, which is down 1.5 per cent.

Prices in Perth are down just 0.4 per cent while they are dead flat in Brisbane and are up 0.4 per cent in Adelaide.

It is a long way from a crash. More like a slight stumble.

The drivers of prices in the current cycle

Key factors supporting house prices in the current cycle are stunning low interest rates and favourable affordability.

Those fortunate enough to have a safe full-time job have had a massive boost in their borrowing and purchasing power in the last couple of years. As noted last week, the cost of servicing a $500,000 mortgage is remarkably low. It appears people are stepping up and are supporting the market.

The latest housing finance data show that first home buyers are also entering the market in huge numbers with investors less prominent due, it appears, to lower rental yields and a small negative gearing tax deduction because of low interest rates. Home ownership rates are likely stabilising after several decades of decline.

Offsetting those positive are headwinds from a slump in demand with low immigration and solid supply as dwelling completions roll through different cities and the regions. These factors mean there remain some downside risks to prices over the next year or so.

The house price bet

Which brings me to the bet I made two years ago with Tony Locantro from Alto Capital in Perth.

In September 2018, I had had enough of the headline-grabbing snake oil from those expecting house prices to collapse. I saw the 60 Minutes television program giving coverage to one of those calls for prices to crash by 40 per cent or more and as a result, I made an offer for a bet, with generous odds attached.

To his credit, Tony Locantro stepped up where others feared and the bet was made.

Here are the terms of the bet:

We are wagering $15,000 to $2,500 that Sydney or Melbourne or national wide house prices will or will not fall by more than 35 per cent from their peak at any stage before and up to the December quarter 2021.

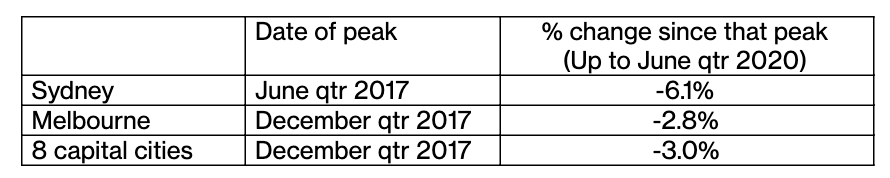

The measure will be based on the Australian Bureau of Statistics Residential Property Price Indexes, Eight Capital Cities, Catalogue No. 6416.0.

This means that if, at any stage the price index for any of Sydney, Melbourne or the aggregate eight capital cities prices is down 35.0 per cent or more, I will give Tony $15,000 cash. Conversely, if by the time the December quarter 2021 data are published and the peak to trough decline is 34.9 per cent or less in Sydney, Melbourne or the eight capital cities, Tony has to give me $2,500.

With the ABS data for the June quarter, here is the table of how that bet is panning out, with six quarters of data to go.

So far, of the markets covered in the bet, Sydney is the weakest, with the fall from the peak three years ago just 6.1 per cent. Melbourne and the eight capital city price falls are just 3 per cent, a long, long way from the 40 per cent declines the pessimists were predicting.

To be sure, a lot can happen in the next 18 months and there is a risk, albeit remote, that prices could collapse.

At this stage, even with an unexpected health crisis and deep recession, Australian house prices are resilient and the odds of a 35 per cent price fall now look to be about 100 to 1.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.