5 steps to buying a property

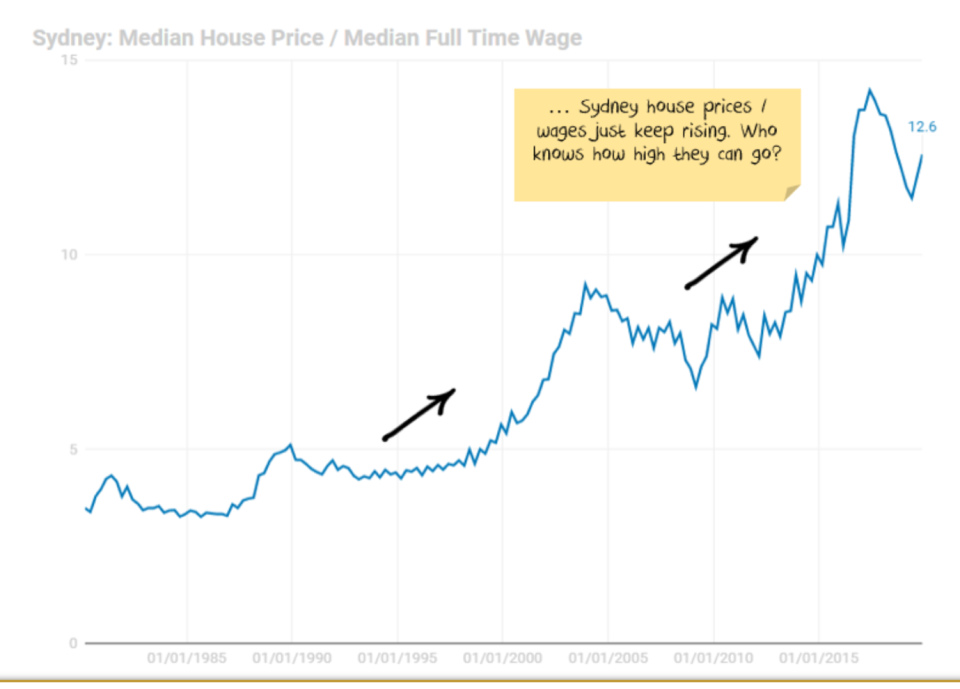

If you want to buy a property now, take a really close look at this chart for Sydney house prices and then stop and think.

Look at the boom from 1997 to 2003. Note how prices moved sideways with a little price uplift until 2012 and then they took off again. This chart does not show what happened to property prices over 2017 and 2018 but this one does and it shows it compared to wages.

This shows prices don’t rise forever and given we are moving into another house price rebound period for the market, over-borrowers who might be wanting to buy and flip and sell a property in a few years could get caught out.

Buying now and being prepared to tolerate a period of lower prices or sideways prices might be OK, provided you love where you’re buying, your job is safe and you and your partner (if you have one) expect nice pay rises over time.

More from Peter Switzer: Be a customer that Afterpay and the banks just don’t like

More from Peter Switzer: The first step to getting richer

More from Peter Switzer: Your 5-minute guide to trading stocks online

The best time to buy is at the bottom of the cycle, when everyone is scared and nervous. If you can’t time that, try and buy after a year or two of rising prices.

One strategy worth thinking about is to buy a property where you want to live but can’t afford. If you’re earning good income and pay a lot of tax, you could become a temporary landlord or property investor, until your income grows to justify the high repayments with the property you can’t afford to live in now.

Other people in this situation decide to be a renter where they want to live and buy rental properties in areas in other suburbs, regions or states where they can earn nice rents and benefit from capital gain over time.

Whatever you decide to do, follow these steps:

1. Set your property goal.

2. Do a lot of research and speak with experts such as accountants, real estate agents and so on to boost your knowledge.

3. Be certain you use the tax system to your advantage.

4. Don’t over-borrow.

5. Have a B-plan if things go wrong, such as you lose a job, interest rates go too high or you get sick!

As I always say, people who make money mistakes, don’t plan to fail, they simply fail to plan!

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.