Volatility 101: Should Wealthy Way Group (HKG:3848) Shares Have Dropped 11%?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. Investors in Wealthy Way Group Limited (HKG:3848) have tasted that bitter downside in the last year, as the share price dropped 11%. That's well bellow the market return of -1.0%. Because Wealthy Way Group hasn't been listed for many years, the market is still learning about how the business performs.

Check out our latest analysis for Wealthy Way Group

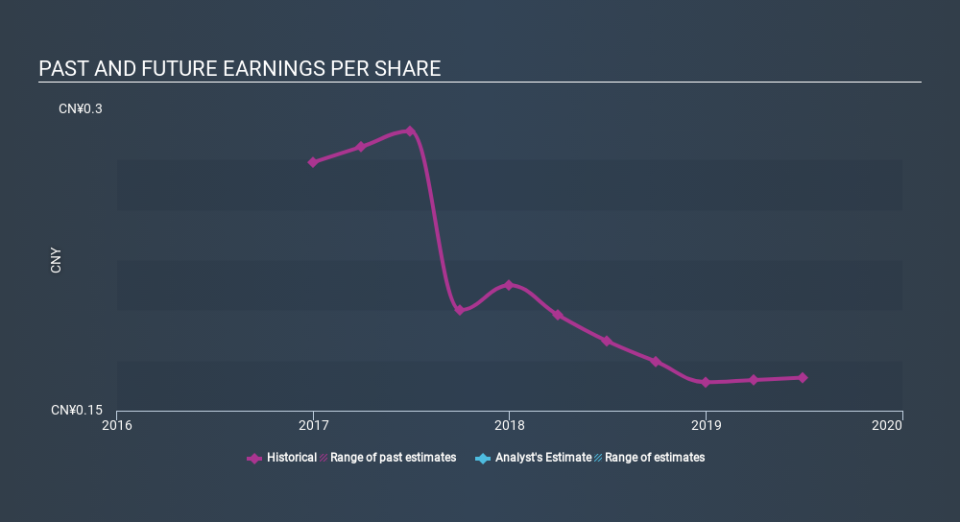

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Wealthy Way Group reported an EPS drop of 9.9% for the last year. We note that the 11% share price drop is very close to the EPS drop. Therefore one could posit that the market has not become more concerned about the company, despite the lower EPS. Rather, the share price is remains a similar multiple of the EPS, suggesting the outlook remains the same.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Wealthy Way Group's earnings, revenue and cash flow.

A Different Perspective

We doubt Wealthy Way Group shareholders are happy with the loss of 10% over twelve months (even including dividends) . That falls short of the market, which lost 1.0%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Putting aside the last twelve months, it's good to see the share price has rebounded by 0.3%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with Wealthy Way Group (including 1 which is is a bit concerning) .

Wealthy Way Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.