Volatility 101: Should Maxim Power (TSE:MXG) Shares Have Dropped 39%?

Maxim Power Corp. (TSE:MXG) shareholders should be happy to see the share price up 15% in the last week. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 39% in the last three years, significantly under-performing the market.

View our latest analysis for Maxim Power

Because Maxim Power made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Maxim Power grew revenue at 77% per year. That's well above most other pre-profit companies. While its revenue increased, the share price dropped at a rate of 15% per year. That seems like an unlucky result for holders. It's possible that the prior share price assumed unrealistically high future growth. Before considering a purchase, investors should consider how quickly expenses are growing, relative to revenue.

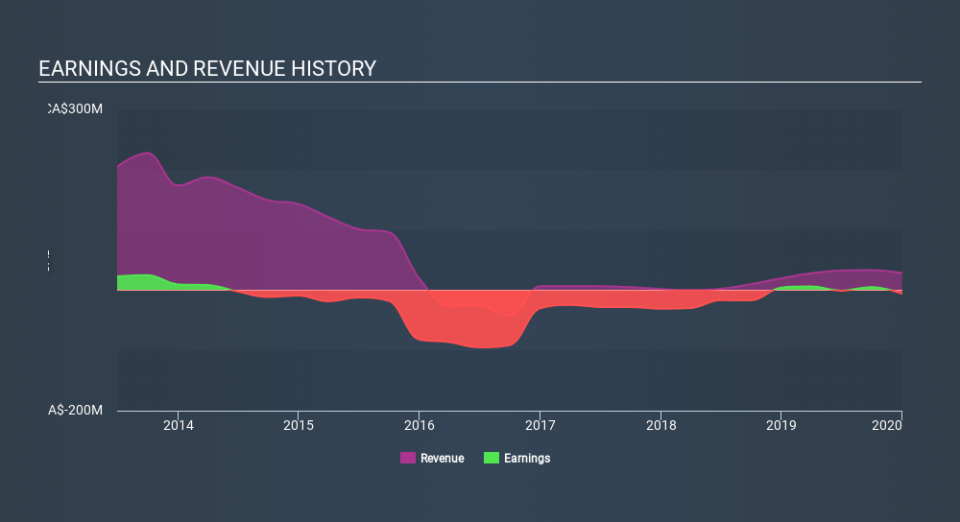

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of Maxim Power's earnings, revenue and cash flow.

A Different Perspective

Although it hurts that Maxim Power returned a loss of 18% in the last twelve months, the broader market was actually worse, returning a loss of 21%. Unfortunately, last year's performance may indicate unresolved challenges, given that it's worse than the annualised loss of 8.3% over the last half decade. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. It's always interesting to track share price performance over the longer term. But to understand Maxim Power better, we need to consider many other factors. For instance, we've identified 4 warning signs for Maxim Power (1 doesn't sit too well with us) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.