US Fed leads charge against economic hit from coronavirus

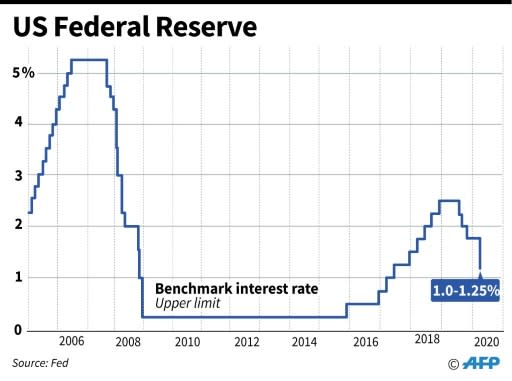

The US Federal Reserve led the charge in the global response to the growing economic risk posed by the coronavirus, announcing an emergency interest rate cut Tuesday to boost confidence. But the immediate impact seemed the opposite of what was intended: investors fled to safe assets, sending the 10-year Treasury to its lowest ever return while stocks lost most of the ground recovered Monday. That move came after weeks of haranguing by President Donald Trump for more stimulus, but he was not satisfied and called for even more. In a unanimous decision, the Fed's policy-setting committee slashed its key interest rate by a half point to a range of 1.0-1.25 -- the first inter-meeting cut since late 2008 at the height of the global financial crisis. The large, highly unusual move made just 15 days before the next scheduled policy meeting reflected growing concerns that the spreading virus will take a bite out of the US and global economies as supply chains linked to China, the epicenter of the outbreak, are shut down. "My colleagues and I took this action to help the US economy keep strong in the face of new risks to the economic outlook," Fed Chair Jerome Powell said in a press conference. The market reaction seems to support the concerns of economists who worry the aggressive move goes too far and, rather than calm fears, could unsettle investors worldwide if they view it as a sign the US central bank expects a recession. The Dow Jones Industrial average lost nearly three percent, or 800 points, eroding most of the ground recovered on Monday, while the yield on the 10-year Treasury bond fell below 1.0 percent for the first time ever. While Powell said the US economy remains on solid footing with a strong labor market supporting household spending, the broader spread of the virus is disrupting economic activity and "the risks to the US outlook have changed materially." The Fed chief said it is too soon to know how persistent and severe the impact will be, and acknowledged that cutting interest rates does nothing to fix the broken supply chain. But, Powell said, "we do believe that our action will provide a meaningful boost to the economy... and will help boost household and business confidence." The cut was not enough for Trump, who demanded the central bank "further ease and, most importantly, come into line with other countries/competitors." "We are not playing on a level field. Not fair to USA. It is finally time for the Federal Reserve to LEAD. More easing and cutting!" Trump tweeted. - International coordination - Powell once again denied the central bank is bowing to political pressures, saying "we make our decisions in the interests of the American people" based on "the best analysis and research." Companies worldwide have been buffeted by actions taken by governments to stem the outbreak that emerged in China, where entire cities have been locked down and factories shut. Fears that the crisis will deepen sent global equity markets into a tailspin last week, and data show US manufacturers expect more trouble ahead as they try to access supplies. The outbreak has now killed more than 3,100 people and infected over 90,000 as it spreads around the world. The Fed decision came just hours after Group of Seven finance ministers and central bankers pledged to take action using "all appropriate policy tools" to respond to the virus. Powell said every central bank must do what it thinks best for its own economy but added that "it's possible there will be some more formal coordination as we move forward." - Too much or just right? - Most of the world's advanced economies -- Britain, Canada, France, Germany, Italy, Japan and the United States -- have very low or negative interest rates, so the Fed was perhaps best-placed to make a move. But monetary policy takes at least six months to have an impact on the real economy, by which point the epidemic may have passed. "It was clearly agreed that central banks, at the very least, would take the lead in cutting rates: Australia cut today, Malaysia cut today, New Zealand and Indonesia yesterday, the Bank of Japan has sent some encouraging signs out there," Karl Haeling of LBBW told AFP. The Bank of Canada holds its policy meeting Wednesday, followed by the European Central Bank on March 12, and the Bank of Japan on March 18. But Peter Cardillo of Spartan Capital Securities cautioned that the Fed move "sends the wrong message to the market." Economist Joel Naroff was more blunt: "They panicked and wasted most of what is left of their precious ammunition." US Federal Reserve Chairman Jerome Powell denied the central bank was bowing to political pressure in the aggressive emergency interest rate cut US President Donald Trump has called for the central bank to cut further US Federal Reserve benchmark lending rates Economists warn the Fed's aggressive move sends the wrong signal to financial markets