‘Risks are building’ for Australia as US, EU hit by second wave

Prominent economists have become increasingly concerned about the potential economic damage of America and Europe’s rising Covid-19 case numbers on Australia’s economy, warning that the nation could be “hit hard”.

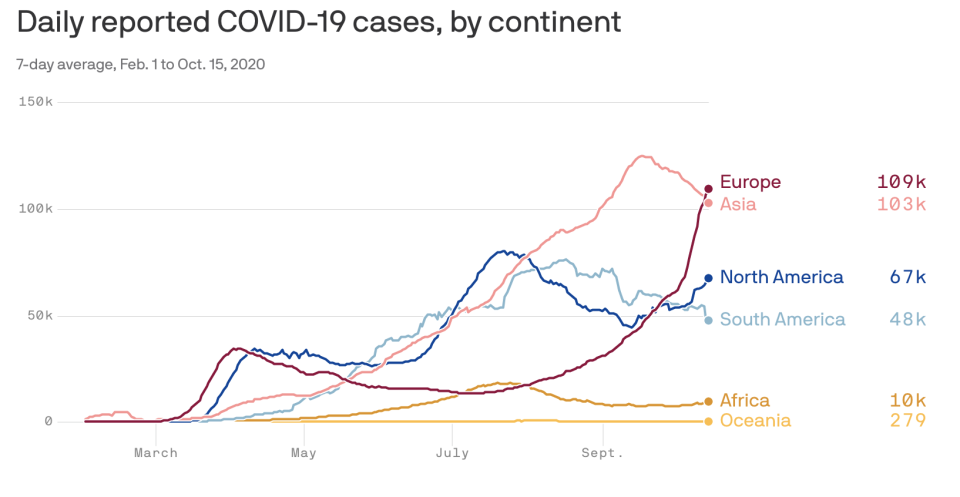

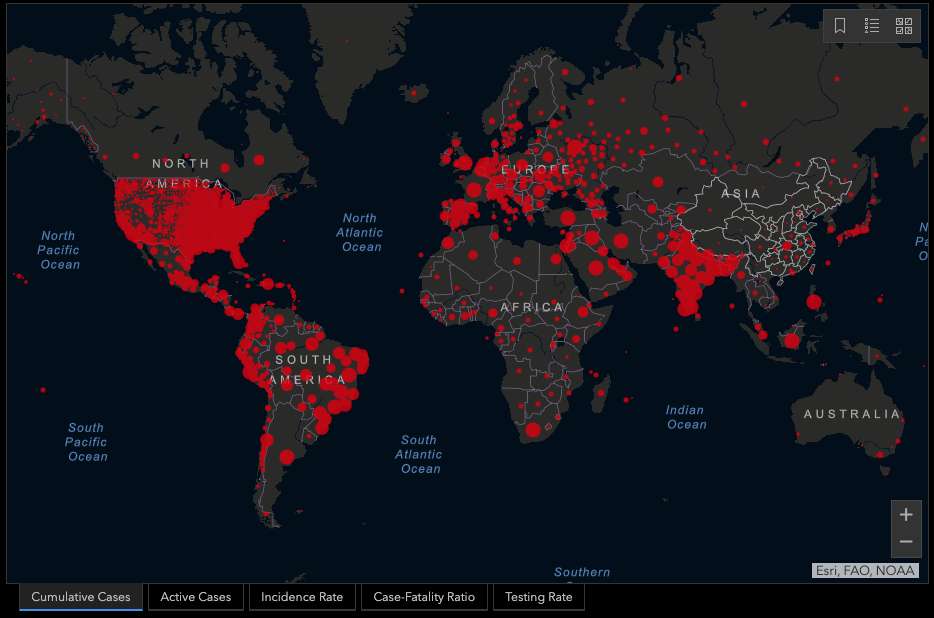

Several European countries, such as France, Spain, Germany and Czech Republic have smashed their record case numbers in the last two weeks, with deaths in these countries also climbing.

Meanwhile, the number of new cases in America rose for five days in a row last week, peaking on 16 October when the superpower announced 70,451 new cases from the day before.

Independent economist Stephen Koukoulas said the Australian economy had, until recently, been benefiting from a “relatively solid export performance” thanks to China’s rebounding economy as well as “signs of an upturn” in the US and Europe.

“If the spread in Covid-19 leads to new lock downs and a double dip recession then Australia will be hit hard not just through exports, but also from what could be heightened market volatility,” he told Yahoo Finance.

“Suffice to say, the risks are building as the pandemic reemerges in the US and Europe.”

Also read: Bill Gates on the global problem ‘much harder’ than Covid-19

Also read: ‘Long-lasting scars’: IMF’s dire warning about the global economy

Echoing Koukoulas’ sentiments, JP Morgan Asset Management’s global market strategist Kerry Craig said the greatest danger to Australia was quashed optimism about an economic recovery.

“The risk to Australian investors comes via any flow on effect [to] positive sentiment that has gripped markets of late,” he told Yahoo Finance.

“Australia is an open economy exposed to the global outlook and if that outlook sours because of more Covid-19 cases and risk sentiment changes, then Australia will not be completely insulated.”

Additionally, many of the states that are contributing to the rising cases are swing states, and therefore significant to the upcoming US federal election, he noted.

And how the US election plays out has massive implications for the stock market.

“Anything which could lead to a change in the current polling and the view that there will be a Democratic sweep of the White House and Congress would mean a market adjustment,” Craig said.

“Investors shouldn’t discount the possibility of a split Congress and should be mindful of taking any large positions until the election outcome is known.”

Asia is the real risk

However, former long-time Austrade chief economist Tim Harcourt told Yahoo Finance that while what was happening with Australia’s western counterparts could potentially stall Australia’s economic growth, it’s what’s happening with our neighbours we should keep a closer eye on.

“Most of our strong trade routes – agriculture, coal, iron ore, liquefied natural gas – they all go into Asia anyway. So the slowing down in the US and Europe is not going to affect us that much,” he said. “Most of the European companies assemble consumer goods in Asia.”

Harcourt would be more alarmed if there were a strong resurgence happening in China, Korea, Singapore, Japan or Indonesia.

The media’s tendency to give more airtime to US and European news also impacts Australians’ perception of the significance of Covid-19 developments in those regions, he added.

But it’s not all bad news

The upside is that relative to other countries, Australia is actually performing comparatively well in handling the pandemic as well as economically.

“Australia is looking more in order than other developed markets at the minute. Fiscal stimulus has been agreed, further monetary stimulus is forthcoming and regulatory changes around lending may ease some of the burden on households,” said JP Morgan’s Craig.

“This, along with a market that has lagged developed peers over much of 2020 may see the local market go through a short period of outperformance in a period of uncertainty.”

BetaShares chief economist David Bassanese said what was more critical than the number of Covid cases was how governments reacted to the associated risks.

“At least up until recently, governments have been keen to avoid a return to draconian lockdowns and have been attempting to ‘learn to live with the virus’,” Bassanese said.

“If we can avoid a return to harsh lockdowns, the current surge in Covid cases need not derail the global recovery, though lingering social distancing restrictions make it even more likely rebound will be gradual. Of course, it's still touch and go whether European governments will be able to avoid a return to lockdown, especially given their more elderly populations and densely populated major cities.

“In the United States, however, the political will to avoid lockdowns is even stronger, and this could be helped to the extent new Covid waves affected smaller towns and cities.”

Nonetheless, all these factors put together can still send Aussie investments for a spin, said Commonwealth Bank senior economist Ryan Felsman.

“Uncertainties over the virus ‘second wave’, a potential vaccine, fiscal stimulus and the US election outcome are likely to introduce bouts of extreme volatility to financial markets over the coming months.

“Australia’s economic outlook is largely dependent on Melbourne successfully emerging from its second lockdown, despite remaining captive to overseas developments.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.