U.K. Is Still Two Levers From Negative Rates

(Bloomberg Opinion) -- Bank of England policymakers moved sterling markets this week after lifting the lid on contingency planning for negative interest rates. The central bank has repeatedly said the sub-zero option is in its toolbox, so it makes sense to signal it won’t reach for it without reading the manual. Investors should welcome that — and recognize that the BOE will want to exhaust the alternatives first.

Negative rates could be justified in some scenarios. A no-deal Brexit, an economic downturn as the U.K.’s furlough employment scheme ends, and a resurgence in cases of Covid-19 are the three variables policymakers must contend with. Despite some positive economic signs lately, there’s no room for complacency.

U.K. consumption is back to pre-pandemic levels. The central bank now expects its forecasts for an 18% bounce in third-quarter gross domestic product to be exceeded. Sadly, that is where the good news may end. If the U.K. reverts to World Trade Organisation trade terms at the end of this year, more drastic fiscal and monetary action from the authorities is a racing certainty. The BOE’s “structured engagement” with U.K. bank regulators on the implementation of negative rates is pragmatic technical planning.

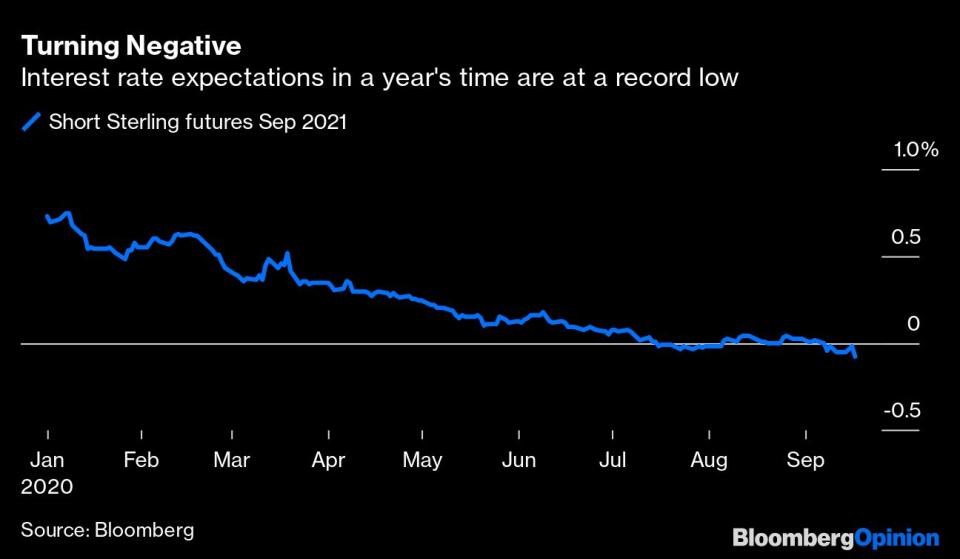

There are still many “ifs”. Futures markets expect negative rates in about a year's time. The central bank’s stated preference is for further rounds of bond buying — so-called quantitative easing — and a 10 basis point cut in the bank rate to zero first. The next meeting of the central bank’s monetary policy committee on Nov. 5 will take place as the current 100 billion-pound ($129 billion) slug of QE should be coming to an end. The market expects a further 100 billion pounds of bond buying to follow.

The bottom line is that the BOE still remains two steps away from taking rates negative. But only two.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Marcus Ashworth is a Bloomberg Opinion columnist covering European markets. He spent three decades in the banking industry, most recently as chief markets strategist at Haitong Securities in London.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.