What Type Of Returns Would Namaste Technologies'(CVE:N) Shareholders Have Earned If They Purchased Their SharesYear Ago?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in Namaste Technologies Inc. (CVE:N) have tasted that bitter downside in the last year, as the share price dropped 48%. That falls noticeably short of the market decline of around 2.5%. On the other hand, the stock is actually up 4.3% over three years. Shareholders have had an even rougher run lately, with the share price down 33% in the last 90 days.

See our latest analysis for Namaste Technologies

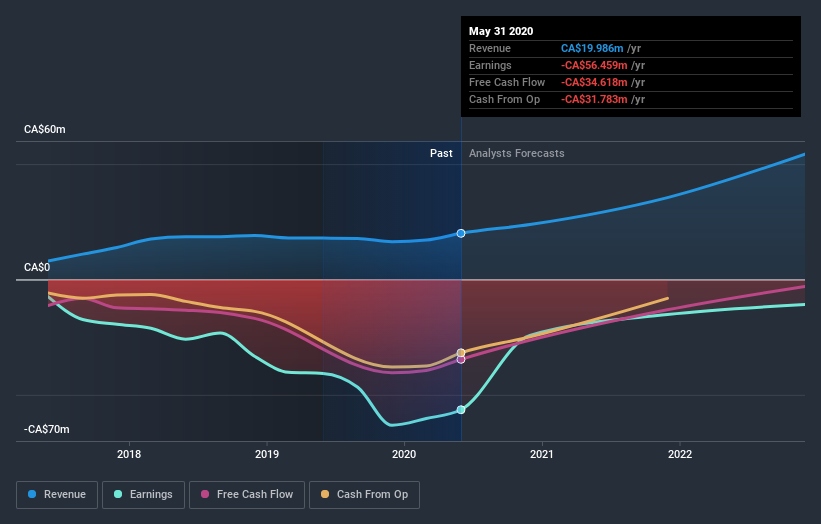

Given that Namaste Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Namaste Technologies grew its revenue by 11% over the last year. While that may seem decent it isn't great considering the company is still making a loss. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 48% in a year. It's important not to lose sight of the fact that profitless companies must grow. But if you buy a loss making company then you could become a loss making investor.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Namaste Technologies' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Namaste Technologies shareholders are down 48% for the year, falling short of the market return. The market shed around 2.5%, no doubt weighing on the stock price. Fortunately the longer term story is brighter, with total returns averaging about 1.4% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Namaste Technologies that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.