Those Who Purchased ManpowerGroup (NYSE:MAN) Shares Three Years Ago Have A 10% Loss To Show For It

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term ManpowerGroup Inc. (NYSE:MAN) shareholders, since the share price is down 10% in the last three years, falling well short of the market return of around 43%. Even worse, it's down 8.4% in about a month, which isn't fun at all. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

View our latest analysis for ManpowerGroup

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, ManpowerGroup actually managed to grow EPS by 7.1% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

We're actually a quite surprised to see the share price down while EPS have grown strongly. So we'll have to take a look at other metrics to try to understand the price action.

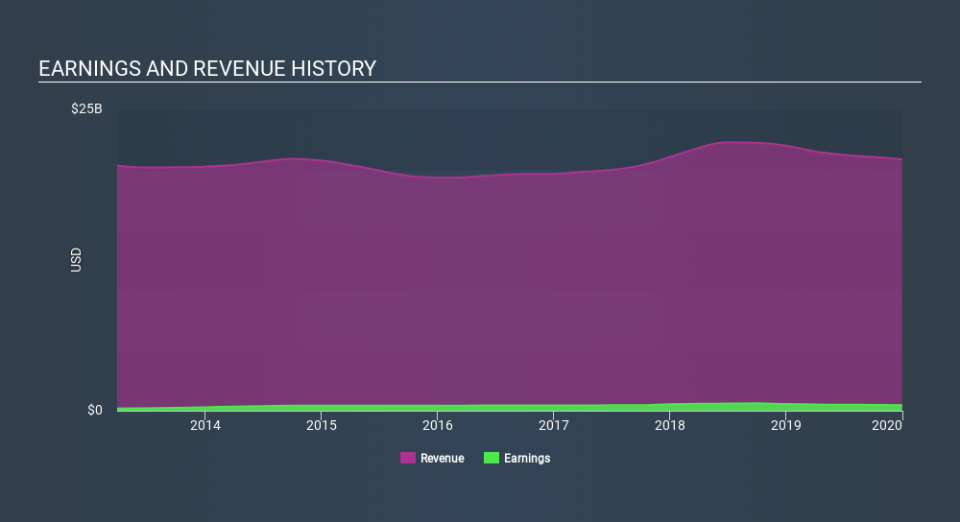

The company has kept revenue pretty healthy over the last three years, so we doubt that explains the falling share price. We're not entirely sure why the share price is dropped, but it does seem likely investors have become less optimistic about the business.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

ManpowerGroup is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling ManpowerGroup stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, ManpowerGroup's TSR for the last 3 years was -4.2%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

ManpowerGroup shareholders gained a total return of 6.9% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 3.6% over half a decade This suggests the company might be improving over time. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.