Those Who Purchased GO2 People (ASX:GO2) Shares A Year Ago Have A 90% Loss To Show For It

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it's not unreasonable to try to avoid truly shocking capital losses. We wouldn't blame The GO2 People Limited (ASX:GO2) shareholders if they were still in shock after the stock dropped like a lead balloon, down 90% in just one year. A loss like this is a stark reminder that portfolio diversification is important. Because GO2 People hasn't been listed for many years, the market is still learning about how the business performs. More recently, the share price has dropped a further 50% in a month. But this could be related to poor market conditions -- stocks are down 25% in the same time.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for GO2 People

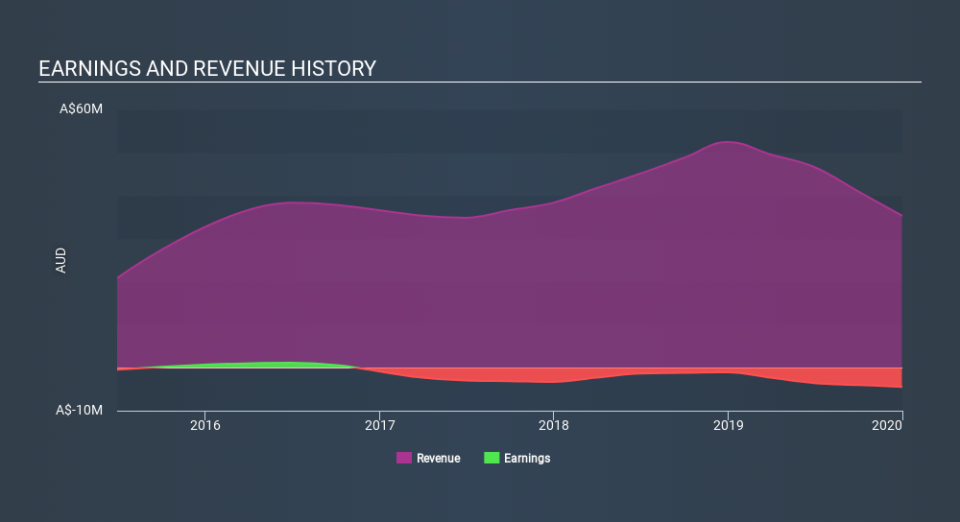

GO2 People isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In just one year GO2 People saw its revenue fall by 33%. That's not what investors generally want to see. The share price fall of 90% in a year tells the story. That's a stern reminder that profitless companies need to grow the top line, at the very least. But markets do over-react, so there opportunity for investors who are willing to take the time to dig deeper and understand the business.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on GO2 People's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

GO2 People shareholders are down 89% for the year, even worse than the market loss of 19%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 47%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - GO2 People has 4 warning signs (and 2 which are concerning) we think you should know about.

But note: GO2 People may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.