Things to Note Ahead of Keurig Dr Pepper's (KDP) Q4 Earnings

Keurig Dr Pepper Inc. KDP is slated to report fourth-quarter 2019 results on Feb 27, before the opening bell. We note that the company delivered a positive earnings surprise of 3.2% in the last reported quarter. In the trailing four quarters, the company’s earnings outperformed the Zacks Consensus Estimate by 3%, on average.

The Zacks Consensus Estimate for fourth-quarter earnings has remained unchanged at 35 cents over the past 30 days. This suggests an increase of 16.7% from the year-ago period’s reported figure. Further, the consensus mark for revenues is pegged at $2,964 million, indicating growth of 5.4% from the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for 2019 earnings is pegged at $1.22 per share, suggesting growth of 17.3%. Further, the Zacks Consensus Estimate for revenues is currently pegged at $11,180 million.

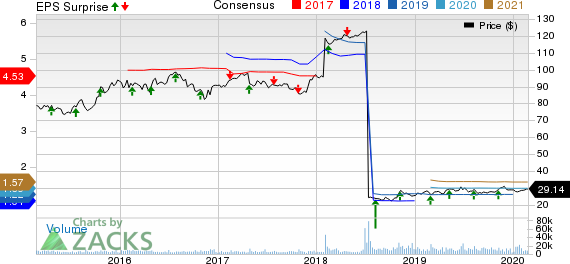

Keurig Dr Pepper, Inc Price, Consensus and EPS Surprise

Keurig Dr Pepper, Inc price-consensus-eps-surprise-chart | Keurig Dr Pepper, Inc Quote

Key Factors to Note

Keurig Dr Pepper has been gaining from its efforts to enhance the portfolio, through partnerships and acquisitions. Also, the company is on track with its efforts to bolster business through the launch of innovative product lines as well as investing in production and supply-chain facilities. On the last earnings call, management guided capturing merger synergies of $200 million in 2019. This gives out positive signals for the quarter under review as well.

The company expected strong sales growth for the fourth quarter. Also, net sales growth is anticipated to be 3% in 2019, which is at the high-end of its long-term sales growth target of 2-3%. The robust sales view is supported by expectations of continued strong performance of core brands and lesser inclination of Allied Brands.

Moreover, significant cash flow generation and rapid deleveraging is expected in 2019. Adjusted earnings per share growth of 15-17% is anticipated. This brings its adjusted earnings guidance to $1.20-$1.22 per share for 2019.

For the fourth quarter, the company stated that the impact of the Allied Brands will switch from a headwind to being a tailwind. However, it notes that the ramp-up of new brands to the Allied portfolio is progressing slower than expected. Consequently, the company expects a delay in realizing the full growth potential of these brands. As a result, it expects net changes in the Allied Brands portfolio to impact total sales by 200 basis points (bps) in 2019 compared with a 100-bps impact expected at the beginning of the year.

Moreover, the company has been grappling with unfavorable currency fluctuation. Additionally, industry-wide challenges, including a slower rate of CSD category growth and higher input costs, remain concerns.

What the Zacks Model Unveils

Our proven model does not predict an earnings beat for Keurig Dr Pepper this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Keurig Dr Pepper carries a Zacks Rank #2 but has an Earnings ESP of 0.00%.

Stocks With Favorable Combinations

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Coca Cola Femsa S.A.B. de C.V. KOF presently has an Earnings ESP of +5.47% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco Wholesale Corporation COST has an Earnings ESP of +0.20% and a Zacks Rank #2 at present.

Limoneira Co LMNR currently has an Earnings ESP of +2.70% and a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

Limoneira Co (LMNR) : Free Stock Analysis Report

Keurig Dr Pepper, Inc (KDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.