New law means up to 1.5 million could miss out on JobSeeker

Australians who accessed their superannuation early could lose access to unemployment support payments, the Department of Social Services has confirmed.

Also read: Revealed: Aussies spend early access super on gambling, beauty products

Also read: So you just raided your super. What next?

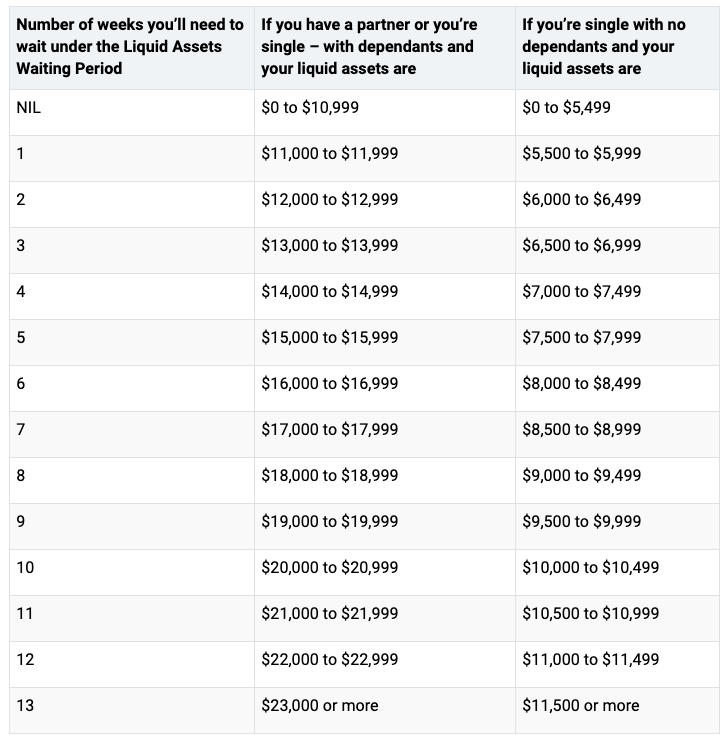

Under the JobSeeker eligibility changes set to come into effect on 25 September, Australians applying for the payment will need to pass the liquid assets test.

The liquid assets test measures the amount of easily available cash Australians have on hand.

If those applying for JobSeeker have more than $5,500 on hand, they may need to wait to access the payment. That waiting period can be as long as 13 weeks for Australians with more than $11,500 in liquid assets.

“If someone has drawn down on their super and that money is now sitting as a liquid asset in their savings account, that will count towards the total of their liquid assets which will be assessed for the liquid asset waiting period,” the Department of Social Services deputy secretary of the Covid-19 Taskforce Nathan Williamson told the Senate Select Committee on Covid-19 on Thursday.

However, added the Department of Social Services Secretary Kathryn Campbell, if that super has been used to pay off debts like credit card or mortgage debt, that cash wouldn’t be counted in the JobSeeker liquid asset test.

“If it was sitting in their bank account, if it had been used to retire debt or pay down a mortgage - those types of mechanisms which we understand some people are using the drawdown of super for - then it wouldn't be counted,” Campbell said.

Around 2.6 million Australians have accessed their super early through the scheme, with 1 million accessing their super twice. And of those, around 60 per cent used it to pay down debts while an additional 36 per cent used it to add to savings, Treasurer Josh Frydenberg said this week.

More than half (58 per cent) of early release payments are categorised as “saved/unspent” and remain in Australians’ bank accounts where they’re saved or used to offset mortgage interest repayments.

‘Harsh reality’: Industry warnings

The clarification comes as the super industry warns of the long-term ramifications of the scheme.

The Australian Institute of Superannuation Trustees (AIST) noted that with a forecast $42 billion of early super withdrawals, the government needs to do more to support Australians in financial stress.

“Initial government estimates of $27 billion of super being accessed have now been increased by more than 150 per cent which indicates that too many working Australians are in financial distress and unable to access sufficient government support,” AIST CEO Eva Scheerlinck said.

“We understand that a great many Australians have had no choice but to rely on their super to get them through the Covid crisis, but the harsh reality is that low income earners and women, who were already facing a retirement savings shortfall, would be hit hard by this scheme,” she continued.

She said the government needs to find other forms of income support beyond allowing savers to draw down on their superannuation.

Australians have been warned that accessing their super early without meeting the criteria risk a $12,600 fine.

Want to take control of your finances and your future? Join the Women’s Money Movement on LinkedIn and follow Yahoo Finance Australia on Facebook, Twitter and Instagram.