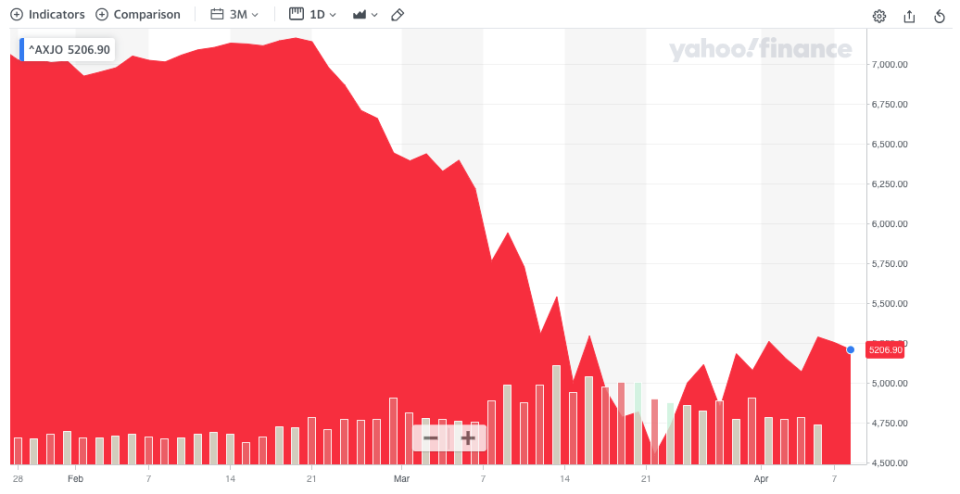

When will the stock market hit rock bottom? 4 signs to look out for

The coronavirus pandemic has sent stock markets into disarray as investors panic-sell their shares amid the outbreak, and the rollercoaster ride looks like it won’t be over for some time yet.

And the reality is, even the experts can’t give an answer for when share markets will stabilise.

“Maybe we have already seen the low for shares – or maybe not? There is still a lot of bad news ahead regarding the virus and the economic hit and we still don’t know how long the shutdown will be for and hence it’s hard to gauge the size and duration of the economic hit, when the recovery will come and what it will be like,” AMP Capital chief economist Shane Oliver wrote in a note.

Stocks are being smashed: Is now a good time to buy shares?

From the Yahoo Finance Breakfast Club: Live Online: Experts’ 9 top tips for starting to invest

Also read: Where to invest during coronavirus

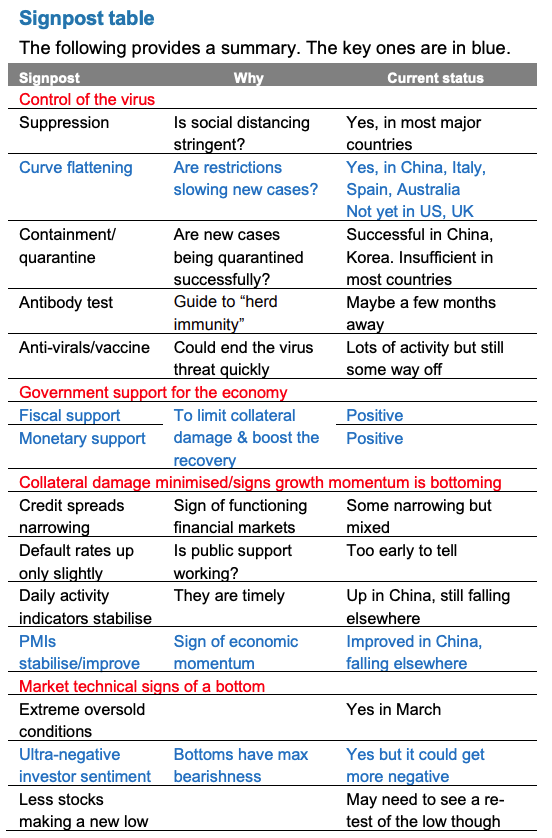

According to Oliver, there are four tell-tale signs that the stock market has bottomed out.

Here’s what they are:

1. Confidence that the pandemic will be contained

Most countries, including Australia, now have strict measures in place to limit the spread of the virus.

“The best thing to watch for is a turn down in the number of new cases,” Oliver said.

Looking at the example of China, new cases peaked 11-21 days after lockdown, after which strict measures can begin to be relaxed.

“This would suggest that the lockdown in Italy and maybe even Australia may be able to be relaxed later this month or in May, if the number of new cases continues to trend down.”

Of course, the risk is that if lockdown is eased too early, you risk a second wave of new cases.

2. Policy measures that support the economy

This is a box Australia has effectively already ticked, with the Morrison government announcing three stimulus packages totalling $213.6 billion from the Commonwealth, $11.8 billion from the state governments and $105 billion in lending from the Reserve Bank and the federal government.

“With policy makers committed to doing whatever it takes, they provide confidence that second round damage from the shutdowns will be kept to a minimum, which will enable economies to recover once the virus is under control.

“We rate this as positive, although more may still need to be done.”

3. Collateral damage kept to a minimum

There are a few economic indicators to keep an eye out for. When these return to normal, we’ll know things have stabilised. According to Oliver, these are the numbers to watch:

Credit spreads: “Corporate and government bond yield gaps need to narrow. They are off their highs, but above normal.”

Money market funding costs: “As measured by the gap between three-month borrowing rates and expected official rates, these have narrowed in Australia but remain high in the US.”

Default rates up only slightly: “This is important in terms of assessing whether public support and debt/rent payment holidays are working. It’s too early to tell in most countries.”

Daily activity indicators (i.e. energy production, traffic congestion) stabilising: “This has been a good indicator in China, but it’s too early in developed countries.”

Business conditions PMIs stabilising/improving: “They’ve improved in China but are still falling elsewhere.”

4. Technical signs of a sharemarket bottom

There are some typical signs of a market bottom, such as “extreme oversold conditions” – which already happened during March – and “apocalyptic investor sentiment”.

Another sign would be an end to the consistently negative investor sentiment that keeps driving markets down.

In a nutshell

Here’s a chart of all the indicators we should be looking out for:

So far, Oliver concluded, we’re seeing some good signs – but it’s also still too early to tell.

“Many of these signposts tick off positively so we may have seen the low. But given the uncertainty around the length of the shutdown, risks of a second wave and very poor economic data to come it’s still too early to say that with confidence,” he wrote.

“Trying to time market bottoms is always very hard so a good approach for long term investors is to average in over several months.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.