Shell (RDS.A) Q3 Earnings Top, Sales Slump, Dividend Raised

Europe’s largest oil company Royal Dutch Shell plc RDS.A reported third-quarter earnings per ADS (on a current cost of supplies basis, excluding items — the market’s preferred measure) of 24 cents. The Zacks Consensus Estimate was of a loss of 6 cents. The outperformance reflects strong retail gains.

However, the bottom line compared unfavorably with the year-ago profit of $1.18 per share. The underperformance mainly stemmed from the coronavirus-induced commodity price collapse and lower production.

The Hague-based Shell reported revenues of $44 billion, which were 49% below third-quarter 2019 sales of $86.6 billion.

On an encouraging note for investors, Royal Dutch Shell boosted its quarterly dividend by about 4% to 16.65 cents after cutting it by two-thirds earlier this year.

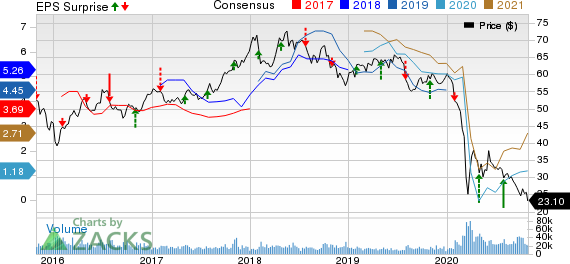

Royal Dutch Shell PLC Price, Consensus and EPS Surprise

Royal Dutch Shell PLC price-consensus-eps-surprise-chart | Royal Dutch Shell PLC Quote

Operational Performance

Upstream: The segment incurred a loss of $884 million (excluding items) against profit of $833 million (adjusted) in the year-ago period. This primarily reflects the impact of sharply lower oil and gas prices as well as production decline.

At $37.92 per barrel, the group’s worldwide realized liquids prices were 32% below the year-earlier levels while natural gas prices were down 37%.

Shell’s upstream volumes averaged 2,203 thousand oil-equivalent barrels per day (MBOE/d), down 14% from the year-ago period due to the OPEC+ production cut agreement and hurricane-related production disruptions in the U.S. Gulf of Mexico. Liquids production totaled 1,520 thousand barrels per day (down 8% year over year), while natural gas output came in at 3,960 million standard cubic feet per day (down 24%).

Oil Products: In this segment, the Anglo-Dutch super-major reported adjusted income of $1.7 billion, 16% lower than the year-ago period. The unfavorable comparison was due to coronavirus-hit sales volumes (down 30% year over year) and lower refining margins, partly offset by a tight leash on operating expenses and robust retail profitability. Meanwhile, refinery utilization came in at 65%, down 13% from the September quarter of 2019.

Integrated Gas: The unit reported adjusted income of $768 million, down 71% from $2.7 billion in the July-September quarter of 2019. Results were primarily impacted by lower commodity prices and a decrease in trading contributions, partly offset by lower operating expenses. Meanwhile, the total Integrated Gas production fell 12% year over year to 844 MBOE/d. On a further bearish note, LNG liquefaction volumes decreased 13% from the third quarter of 2019 to 7.80 million tons.

Chemicals: The segment recorded a profit of $227 million (excluding items) during the quarter, edging up 1% from the year-ago period as lower realized margins were offset by favorable deffered tax adjustments.

Financial Performance

As of Sep 30, 2020, the Zacks Rank #3 (Hold) company, which earlier trimmed its payout for the first time since World War II in April, had $35.7 billion in cash and $109.1 billion in debt (including short-term debt). Net debt-to-capitalization ratio was approximately 31.4%, up from 27.9% a year ago.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

During the quarter under review, Shell generated cash flow from operations of $10.4 billion, returned $1.2 billion to its shareholders through dividends and spent $3.7 billion cash on capital projects.

The company’s cash flow from operations fell 15% from the year-earlier level. Meanwhile, the group raked in $76.billion in free cash flow during the third quarter, decreasing from $10.1 billion a year ago.

Guidance

Shell expects fourth-quarter 2020 upstream volumes of 2,300-2,500 MBOE/d, while Integrated Gas production is expected between 830 MBOE/d and 870 MBOE/d.

Earnings Schedules of Other Oil Supermajors

Among the big integrated players, ExxonMobil XOM and Chevron CVX are scheduled to release tomorrow, while continental rival BP plc BP came up with better-than-expected bottom line numbers earlier this week.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

BP p.l.c. (BP) : Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research