Semiconductor Stocks' Nov 2 Earnings Lineup: ON, SWKS & More

Semiconductor stocks’ quarterly releases are expected to reflect strength in data center markets courtesy of rapid adoption of cloud computing.

Coronavirus-induced work-from-home wave and online learning trends might have bolstered sales of processors utilized in enterprise laptops, and data center servers, which in turn is expected to have benefited the chip stocks in the to-be-reported quarter. Markedly, AMD gained from robust adoption of high-performance processors in the third quarter.

Moreover, per Gartner’s preliminary data, PC shipments in third-quarter of calendar 2020 improved 3.6% year over year to 71.4 million units. (Read More: PC Sales Continue Benefiting From COVID-19 Pandemic-Led Demand)

Likewise, as economies reopen, semiconductor facilities are focusing on utilizing full capacity, which may have bolstered sales. For instance, Intel is adding wafer capacity to boost PC unit volumes in a bid to meet market demand. The company expanded capacity by more than 25% in 2020 and currently has three high-volume fabs producing 10 nanometer (nm) products to cater to customer demands.

Additionally, sequential uptick in global semiconductor sales in July and August is expected to have driven top-line performance of semiconductor companies.

The semiconductor players’ to-be-reported quarter performance is anticipated to have gained from strong adoption of digital transformative techniques and increasing deployment of 5G.

Factors to Note

Momentum in high performance computing (HPC) applications, gaming, wearables, drones and VR/AR devices has been fueling massive growth in the semiconductor space. This can primarily be attributed to the coronavirus crisis, which has led to increase in usage of online services globally.

Moreover, evolution of semiconductor manufacturing processes from 10 nm to 7 nm and even 5 nm technology is opening new business avenues. Further, recovery in automotive end-market on account of easing down of lockdowns and coronavirus-induced shelter-in-place guidelines is likely to have favored the business prospects of the semiconductor companies in the quarter under review.

Besides, the semiconductor stocks’ quarterly releases are expected to reflect the positive impact of improving NAND prices owing to supply constraints triggered by coronavirus crisis.

Furthermore, stay-at-home wave is likely to have driven adoption of cloud computing solutions, including contactless payment, online education portals, cloud-gaming, social media platforms, and other leisure tools, which is expected to have acted as a tailwind.

However, impacts from coronavirus-led sluggishness in IT spending, and anticipated weakness in smartphone end-market are likely to have weighed on the chip companies’ performance in the third quarter.

Markedly, the upcoming earnings releases of component suppliers to Apple, including Cirrus Logic (CRUS) and Skyworks Solutions (SWKS), are likely to reflect impact from decline in iPhone sales in the September quarter. Nevertheless, the launch of the new 5G-supported iPhones is likely to have acted as a tailwind.

Glimpse on Few Upcoming Q3 Releases

Given this mixed backdrop, investors interested in the semiconductor companies keenly await quarterly reports from notable companies like ON Semiconductor Corporation (ON), Cirrus Logic, Rambus (RMBS), Skyworks and Silicon Motion Technology Corporation (SIMO), which are slated to report quarterly results on Nov 2.

Our proven model predicts an earnings beat for ON Semiconductor in third-quarter 2020. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat.

ON Semiconductor has an Earnings ESP of +7.94% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

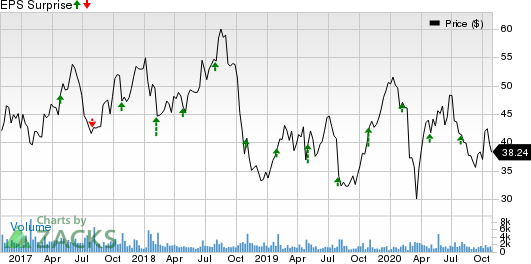

ON Semiconductor Corporation Price and EPS Surprise

ON Semiconductor Corporation price-eps-surprise | ON Semiconductor Corporation Quote

The company’s third quarter results are likely to reflect gains from the solid momentum in image sensors amid consistent growth in advanced driver-assistance systems (“ADAS”) and vehicle electrification domains, driven by uptick in global automotive production.

Moreover, strong traction for silicon carbide (SiC) and silicon power products driven by growth in electric vehicles (EVs) may have acted as a tailwind. Also, robust growth in 5G infrastructure business bodes well. Investments in the 300mm fab in east Fishkill is expected to have aided the company cater to rising demands, which in turn, might have contributed to the top line in the third quarter.

The Zacks Consensus Estimate for third-quarter earnings has been steady in the past 30 days at 19 cents per share.

Skyworks has a favorable combination of a Zacks Rank #2 and an Earnings ESP of +2.20%.

The company’s fourth-quarter fiscal 2020 results performance is anticipated to reflect continued momentum in its 5G and Wi-Fi 6 solutions. Demand continues to be high owing to increased need for high-speed connectivity amid the COVID-19 induced surge in the remote work, video streaming and web-based learning trends. (Read More: What's in Store for Skyworks This Earnings Season?)

Skyworks Solutions, Inc. Price and EPS Surprise

Skyworks Solutions, Inc. price-eps-surprise | Skyworks Solutions, Inc. Quote

The consensus mark for earnings has been revised upward by a cent in the past 60 days to $1.52 per share.

Meanwhile, Silicon Motion has a favorable combination of a Zacks Rank #3 and an Earnings ESP of +7.04%.

The company’s third-quarter 2020 results are likely to reflect gains from increased PC sales triggered by online learning and work-from-home wave owing to the coronavirus crisis. Further, the growing clout of the latest PCIe NVMe SSDs is a positive.

During the second quarter, the company’s PCIe Gen4 SSD controllers raked in new design wins from five NAND flash makers. Further, Silicon Motion’s UFS controller was selected by a notable NAND flash maker. This momentum is likely to have continued in the third quarter.

Further, China’s anticipated economic recovery post lockdown holds promise. Further, positive trends in smartphone embedded storage transitioning from eMMC to UFS controller devices; and shift from HDDs to SSDs across PCs and other client devices bode well.

Silicon Motion Technology Corporation Price and EPS Surprise

Silicon Motion Technology Corporation price-eps-surprise | Silicon Motion Technology Corporation Quote

The company recently reported preliminary third-quarter 2020 results. The company now expects revenues to be 5% above the high-end of the previously guided range of $114-$120 million (mid-point of $117 million) issued on Jul 30. (Read More: Silicon Motion's Upbeat Preliminary Q3 Results Lift NAND Peers)

Notably, the Zacks Consensus Estimate for third-quarter earnings has been revised upward by 6.3% in the past 30 days to 68 cents.

Cirrus Logic’s second-quarter fiscal 2021 performance is likely to have benefited from robust demand for certain components. Solid customer engagement across its portfolio is anticipated to have been a tailwind.

However, decline in smartphone volumes, due to the pandemic-induced shift in demand, is likely to have weighed on the performance of the quarter to be reported. (Read More: What's in the Offing for Cirrus Logic's Q2 Earnings?)

Our proven model does not conclusively predict an earnings beat for Cirrus Logic this time around as it has a Zacks Rank #3 and an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Cirrus Logic, Inc. Price and EPS Surprise

Cirrus Logic, Inc. price-eps-surprise | Cirrus Logic, Inc. Quote

The Zacks Consensus Estimate for quarterly earnings stands at 89 cents. Notably, the figure has remained steady over the past 30 days.

Rambus’ third-quarter 2020 results are likely to reflect increased chip demand from PC manufacturers and data-center operators in the backdrop of current work-from-home and learn-from-home trends amid the COVID-19 pandemic. Rambus, which offers components to semiconductor manufacturers, is anticipated to have gained from this scenario during the quarter under review.

However, increasing spend on product development amid stiff competition in security market is likely to have impacted profitability. (Read More: What's in Store for Rambus This Earnings Season?)

Rambus, Inc. Price and EPS Surprise

Rambus, Inc. price-eps-surprise | Rambus, Inc. Quote

Rambus has a Zacks Rank #4 (Sell) and an Earnings ESP of 0.00%, which makes surprise prediction difficult.

The consensus mark for earnings has been steady in the past 30 days at 27 cents per share.

Have You Seen Zacks’ 2020 Election Stock Report?

The upcoming election could be a massive buying opportunity for savvy investors. Trillions of dollars will shift into new market sectors after the election. The question is, which sectors will soar for each candidate? Zacks has put together a new special report to help readers like you target big profits.

The 2020 Election Stock Report reveals specific stocks you’ll want to own immediately after the results are announced – 6 if Trump wins, 6 if Biden wins. Past election reports have led investors to gains of +71%, +83%, even +185% in the following months. This year’s picks could be even more lucrative.

Check out Zacks’ 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rambus, Inc. (RMBS) : Free Stock Analysis Report

Skyworks Solutions, Inc. (SWKS) : Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

ON Semiconductor Corporation (ON) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research