Here’s how long it takes to save for a house deposit in your city

Australians who live in Sydney and Melbourne will have to save for twice as long for a house deposit than Darwin or Perth residents, new data has revealed.

According to Domain’s latest First-Home Buyer Report, it will take six and a half years to save for a $136,000 house deposit in Sydney, while Melbournians will be saving for six years for a $120,000 deposit.

Domain’s data is based on an average house deposit of 20 per cent on entry-level houses in every capital city, which are unsurprisingly more expensive in Australia’s biggest cities.

Also read: The Aussie city headed for a housing bubble

Canberrans will be saving for five years and five months to put a $121,212 deposit on a home worth around $606,000.

On the other end of the spectrum, Darwinians will only take three years and a month to save just $72,400, and Perth residents will be saving for three years and five months for a deposit of $73,316.

Those living in Brisbane will be saving for four and a half years, with those in Hobart not far behind, having to save for four years and two months.

Adelaideans will be saving for three years and 11 months in order to secure a 20 per cent deposit of $120,000 for a house that costs $600,000.

For some cities, the new data is a far cry from what the property market looked like five years ago.

Melbournians looking to snap up a home now will have to save for 16 months longer than they would have if they house-hunted five years ago, while Darwin property buyers actually save for seven months less than they used to.

Five years ago, Canberra residents would have taken 12 months less to save for a 20 per cent house deposit, whereas Sydneysiders take 4 months longer now to save for a deposit than it would have taken in 2015.

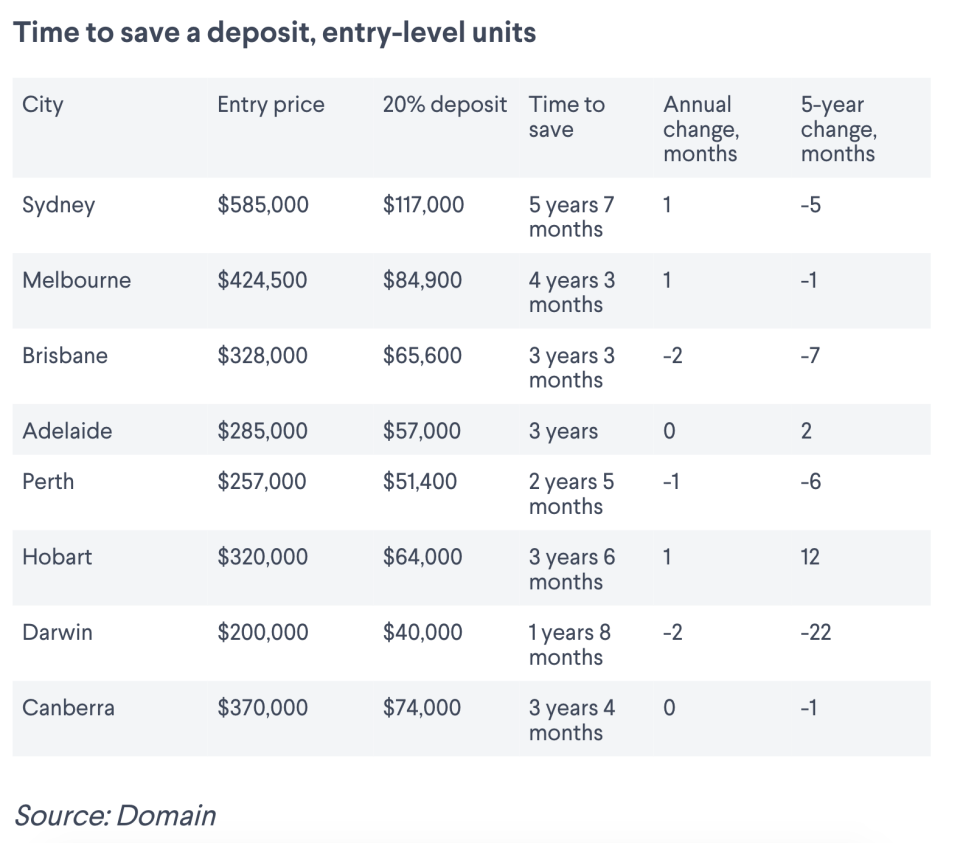

Saving for a unit takes time across the board, but the differences between the capital cities are even greater.

Where it will take Sydneysiders five years and seven months to save for a $117,000 deposit on a $585,000 unit, those living in Darwin will only need to save for a year and eight months for a $40,000 deposit on a $200,000 unit.

Melbourne’s property market has been hamstrung by the second lockdown, but Domain senior research analyst Nicola Powell said there was good news ahead.

“Moving forward, I think there will be improved affordability for first-home buyers,” Powell told Domain.

“The July quarter has seen prices falling for houses [by 0.8 per cent] and units have fallen even further [by 2.3 per cent] so we are expecting the Melbourne market to weaken in the short term before it improves.”

First-home buyers can expect the time needed to save for a deposit to fall over the year, but incentives like stamp duty discounts and other stimulus could keep prices higher, she added.

“We might see the time to save being pushed out again.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.