Rock star Growth Puts GW Pharmaceuticals (NASDAQ:GWPH) In A Position To Use Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, GW Pharmaceuticals plc (NASDAQ:GWPH) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for GW Pharmaceuticals

How Much Debt Does GW Pharmaceuticals Carry?

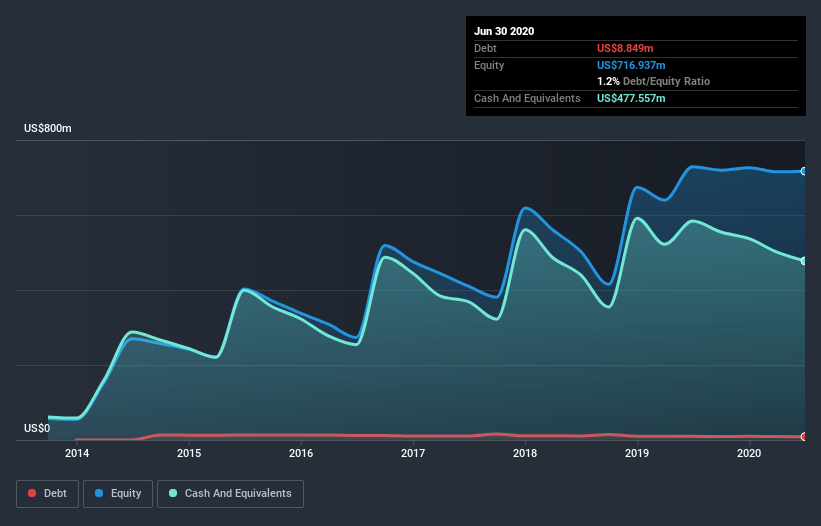

As you can see below, GW Pharmaceuticals had US$8.85m of debt at June 2020, down from US$9.69m a year prior. However, its balance sheet shows it holds US$477.6m in cash, so it actually has US$468.7m net cash.

How Healthy Is GW Pharmaceuticals's Balance Sheet?

The latest balance sheet data shows that GW Pharmaceuticals had liabilities of US$118.5m due within a year, and liabilities of US$35.1m falling due after that. On the other hand, it had cash of US$477.6m and US$80.4m worth of receivables due within a year. So it actually has US$404.3m more liquid assets than total liabilities.

This surplus suggests that GW Pharmaceuticals has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that GW Pharmaceuticals has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if GW Pharmaceuticals can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, GW Pharmaceuticals reported revenue of US$442m, which is a gain of 264%, although it did not report any earnings before interest and tax. That's virtually the hole-in-one of revenue growth!

So How Risky Is GW Pharmaceuticals?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that GW Pharmaceuticals had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through US$106.1m of cash and made a loss of US$55.5m. With only US$468.7m on the balance sheet, it would appear that its going to need to raise capital again soon. The good news for shareholders is that GW Pharmaceuticals has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for GW Pharmaceuticals you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.