Reflecting on Sabre Insurance Group's (LON:SBRE) Share Price Returns Over The Last Year

Most people feel a little frustrated if a stock they own goes down in price. But sometimes a share price fall can have more to do with market conditions than the performance of the specific business. So while the Sabre Insurance Group plc (LON:SBRE) share price is down 14% in the last year, the total return to shareholders (which includes dividends) was -8.1%. And that total return actually beats the market decline of 14%. Sabre Insurance Group may have better days ahead, of course; we've only looked at a one year period.

View our latest analysis for Sabre Insurance Group

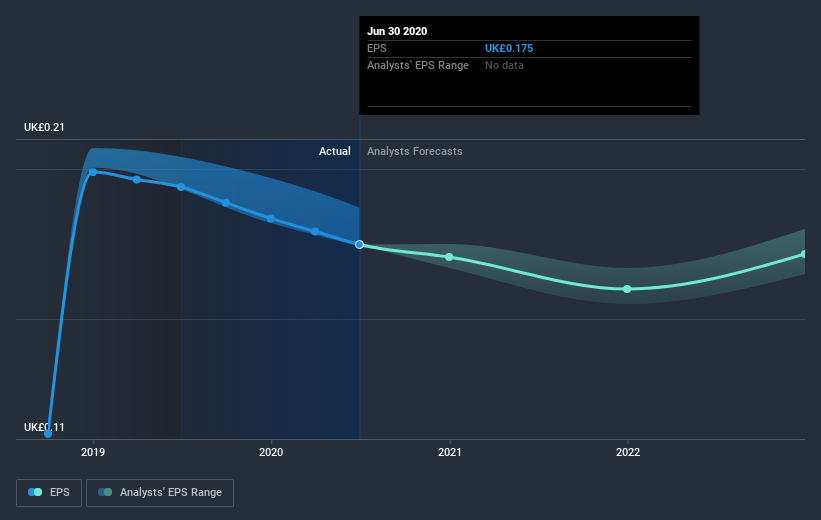

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unhappily, Sabre Insurance Group had to report a 9.8% decline in EPS over the last year. The share price decline of 14% is actually more than the EPS drop. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free interactive report on Sabre Insurance Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Sabre Insurance Group's TSR for the last year was -8.1%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's not great that Sabre Insurance Group shares failed to make money for shareholders in the last year, but the silver lining is that the loss of 8.1%, including dividends, wasn't as bad as the broader market loss of about 14%. Unfortunately for shareholders, the share price momentum hasn't improved much with the stock down 3.6% in around 90 days. Momentum traders would generally avoid a stock if the share price is in a downtrend. We prefer keep an eye on the trends in business metrics like revenue or EPS. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Sabre Insurance Group you should be aware of, and 1 of them is concerning.

Sabre Insurance Group is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.