RBA makes interest rate decision as $75b panic looms

The Reserve Bank of Australia (RBA) will keep interest rates on hold in July as experts predict the next interest rate move won’t be for years.

Also read: RBA's next move will be 'boring': Economist

Also read: $90 billion needed to save Australia’s economy: report

Also read: Staggering cost of jobs ‘saved’ by JobKeeper revealed

The RBA hasn’t moved rates from their record low 0.25 per cent level since March as Australia battles the twin challenges of coronavirus and the economic fallout.

All 43 experts and economists on Finder’s interest rate panel predicted a hold verdict. Most experts agreed rates wouldn’t increase until at least 2022 as low wage growth, inflation and employment present major barriers to growth.

“We have years of low interest rates ahead of us and the banks themselves have sharpened their pencils in recent times, cutting their rates on various products to remain competitive,” Laing + Simmons Leanne Pilkington said.

“The pandemic continues to cast a shadow over the economy and the outlook is meagre, but for those whose income remains secure, a real estate purchase is comparatively affordable at present.”

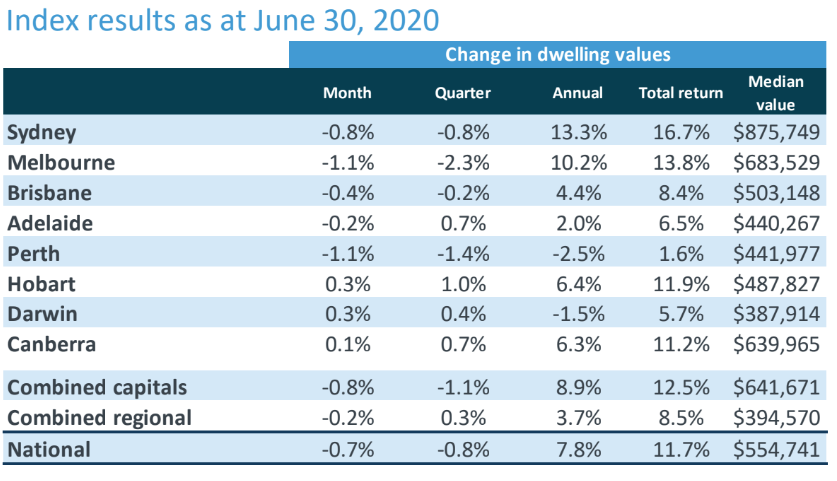

The national house price index fell 0.7 per cent in June, marking the second consecutive fall in value after it fell 0.4 per cent in May.

$75 billion ‘cliff’

Mozo on Tuesday warned that even with record low rates, Australia’s homeowners are under the pump.

“By offering banks a wholesale interest rate of 0.25 per cent for three years, the Reserve Bank is helping to reduce cost for lenders and encourage competitive home loan rates,” Mozo spokesperson Tom Godfrey said.

But he warned Australia still faces a potential $75 billion home loan default cliff in September when JobKeeper payments and banks’ six month mortgage holidays end.

The Mozo research found 53 per cent of mortgage holders fear they may have to sell their home if they’re unable to meet mortgage repayments, with 14 per cent describing their mortgage repayments as their most stressful financial burden.

And Australians could be selling at a low: Finder research released this week found experts predict falls of up to 8 per cent in property values by the end of September.

“Increasingly, auctions are topping-out at final bids well below reserve,” Graham Cooke, insights manager at Finder, said.

“With more job uncertainty on the horizon, it’s difficult to see any improvement in the near future,” Cooke said.

Recovery ‘highly uncertain’

The July decision comes as Victoria marks its largest number of new cases ever, with 190 cases appearing in the state.

This somber fact wasn’t lost on RBA Governor Philip Lowe who warned the recovery is “highly uncertain”.

“Uncertainty about the health situation and the future strength of the economy is making many households and businesses cautious, and this is affecting consumption and investment plans,” Lowe said.

Continuing, he said the recovery will force a major workforce restructuring as many businesses that shed workers will instead choose to absorb or adapt to smaller workforces rather than rehire.

“The Australian economy is going through a very difficult period and is experiencing the biggest contraction since the 1930s. Since March, an unprecedented 800,000 people have lost their jobs, with many others retaining their job only because of government and other support programs,” he said.

“Conditions have, however, stabilised recently and the downturn has been less severe than earlier expected. While total hours worked in Australia continued to decline in May, the decline was considerably smaller than in April and less than previously thought likely.”

Around 800 businesses that are currently being propped up by JobKeeper will likely begin to fail in September, Finder research found. And as many as 1,400 insolvencies will occur by the end of the third quarter, the panel of experts predicted.

“At this point, it is more of a question of ‘when’ than ‘if’ many companies become insolvent,” Cook said.

“Referring to them as ‘zombies’ kept alive only by taxpayer money is a convenient way to remove the human component of the coming pain. The people affected will not be the undead, but they will be those who were trying to cross the so-called ‘bridge to the other side’ only to find that they ran out of time,” he said.

Around 800 insolvency actions began in both February and March, with Cooke warning the

Cooke noted that around 800 insolvency actions were initiated in both February and March.

“Economists aren’t predicting an enormous influx of insolvencies right away in September, but the 800 prediction is deceptive because many expect the worst to come in the months that follow,” he added.

Join the Women’s Money Movement on LinkedIn and follow Yahoo Finance Australia on Facebook, Twitter and Instagram.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.