Why property prices will shoot up after the pandemic

Property price growth is expected to skyrocket following the coronavirus crisis, if past economic recoveries are anything to go by.

Experts are forecasting house values to shoot up at the end of the pandemic, which is consistent with what tends to happen after economic shocks.

According to Propertyology managing director Simon Pressley, real estate prices have traditionally led economic recoveries in past crises.

“Residential real estate is the one thing which is common to 25.5 million Australians. After all, shelter is an essential commodity.”

Also read: Millions of Australians fall through the cracks in recovery bridge

Also read: The property hotspots worth investing in despite coronavirus

Also read: Why now is the right time to buy a house

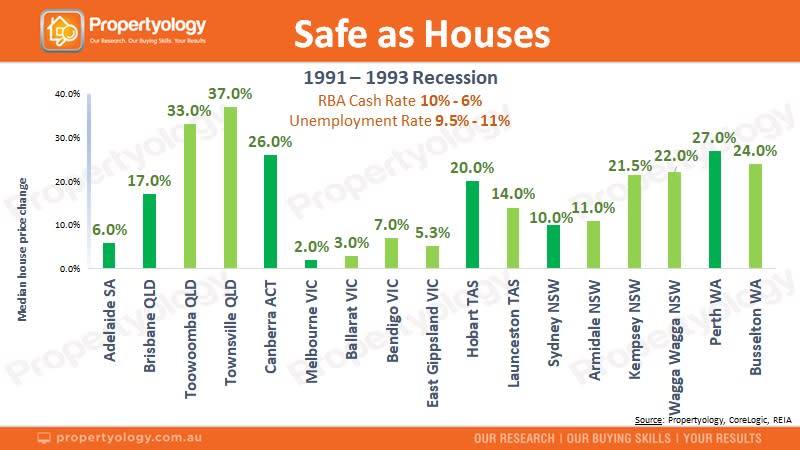

The last time Australia had a recession was 29 years ago – and real estate led the rebound out of the downturn back then.

“Over those three years ending 1993, eight out of eight capital cities produced property price growth of between 2 per cent (Melbourne) and 27 per cent (Perth),” he said, adding that the performance of regional property markets were strong, if not stronger than capital cities.

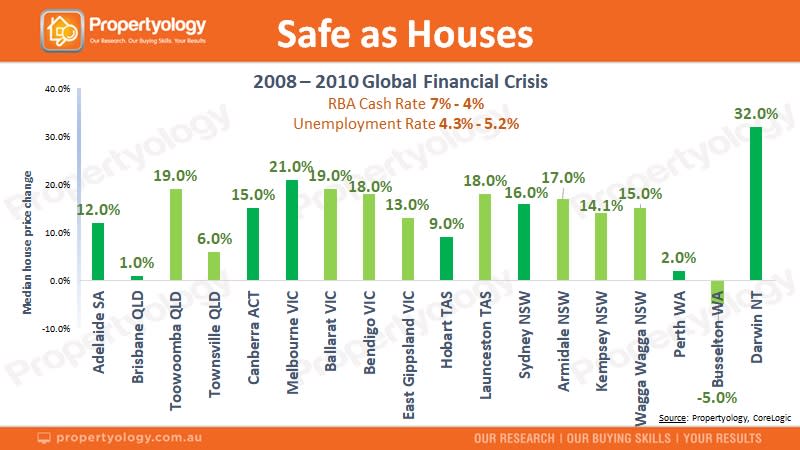

Australia was the only country to avoid a recession when the global financial crisis hit the rest of the world – and between 2008 and 2010, property prices in all capital cities rose, as did regions such as Ballarat, Bendigo, Launceston and Armidale.

The nation’s housing market will cop a hit from the coronavirus pandemic – but it won’t last long, said hotspotting.com.au director Terry Ryder.

“I expect a short-term hit (which will vary from location to location) and then a strong rebound,” he said.

According to AMP Capital chief economist Shane Oliver, the property upswing will depend on several factors, including how far house values fall as well as how long the national shutdown will last.

“I suspect that if the shutdown ends by mid year resulting in minimal second-round damage to the economy (eg unemployment contained to around 10 per cent) and prices falling say 5-10 per cent, then all the stimulus should see a pretty decent bounce in prices into next year of around 10 per cent or so,” he told Yahoo Finance.

“But if the shutdown goes for much longer, unemployment rises to say 15 per cent and prices fall say 20 per cent, the recovery may be much slower.”

The upside to this crisis

According to Pressley, no two crises are the same, but this pandemic actually has some good things going for it: the cause for this crisis is known and has a time frame, there is global coordination in dealing with the crisis, and many countries have learnt their lessons from the GFC.

On top of that, the property market has been “largely suppressed” in the two years leading up to Covid-19, and the government’s stimulus packages will stem a spike in distressed property sales, Pressley said.

“In the coming months, as Australia gains confidence that we are getting on top of this nuisance germ, the attention of all levels of government will turn to policies to crank the economy back up,” he said.

Where are the investment opportunities?

According to Ryder, investors who are able to “think and act independently of the herd” will fare well.

“The herd will retreat and there will be relatively little competition from other buyers,” he told Yahoo Finance.

“The fundamentals still apply, so target locations with diverse economies, growing populations and affordable real estate.”

Realestate.com.au chief economist Nerida Conisbee said premium suburbs in capital cities would perform well (“this is likely to be because people perceive these areas to hold value better than cheaper areas”), as well as affordable areas that will be sought after by bargain hunters.

“By capital city, Canberra appears to be holding up much better than the rest of Australia due to very high levels of government employment,” she added.

“Strong demand for resources is likely to underpin housing demand in cities and towns that rely on mining for economic growth.”

Areas that have a high volume of rental properties will struggle, as well as markets that are dependent on tourism.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.