Polaris Media (OB:POL) Seems To Use Debt Quite Sensibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Polaris Media ASA (OB:POL) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Polaris Media

How Much Debt Does Polaris Media Carry?

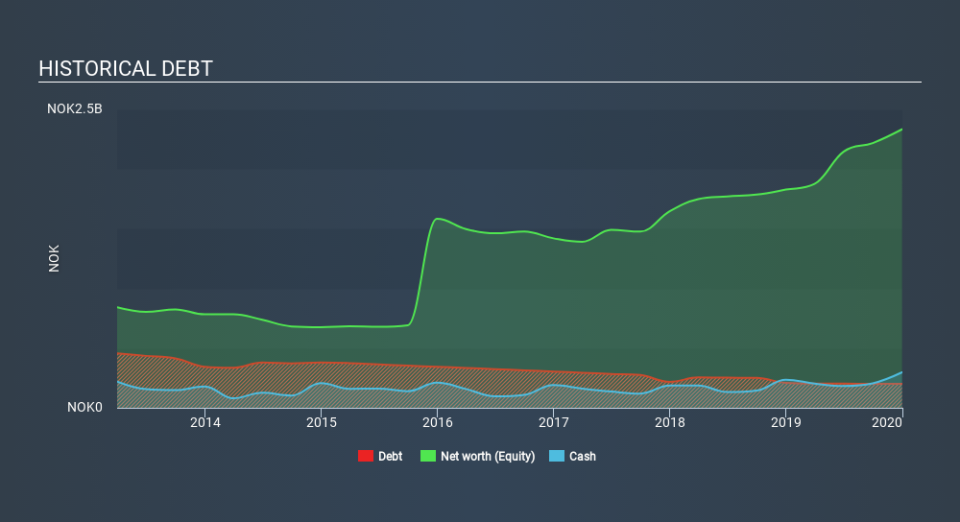

As you can see below, Polaris Media had kr201.4m of debt, at December 2019, which is about the same the year before. You can click the chart for greater detail. However, its balance sheet shows it holds kr297.4m in cash, so it actually has kr96.1m net cash.

How Healthy Is Polaris Media's Balance Sheet?

We can see from the most recent balance sheet that Polaris Media had liabilities of kr890.4m falling due within a year, and liabilities of kr926.2m due beyond that. Offsetting these obligations, it had cash of kr297.4m as well as receivables valued at kr224.4m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr1.29b.

This is a mountain of leverage relative to its market capitalization of kr1.79b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. Despite its noteworthy liabilities, Polaris Media boasts net cash, so it's fair to say it does not have a heavy debt load!

And we also note warmly that Polaris Media grew its EBIT by 12% last year, making its debt load easier to handle. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Polaris Media will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Polaris Media has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Polaris Media actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

While Polaris Media does have more liabilities than liquid assets, it also has net cash of kr96.1m. The cherry on top was that in converted 126% of that EBIT to free cash flow, bringing in kr113m. So we don't have any problem with Polaris Media's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Polaris Media (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.