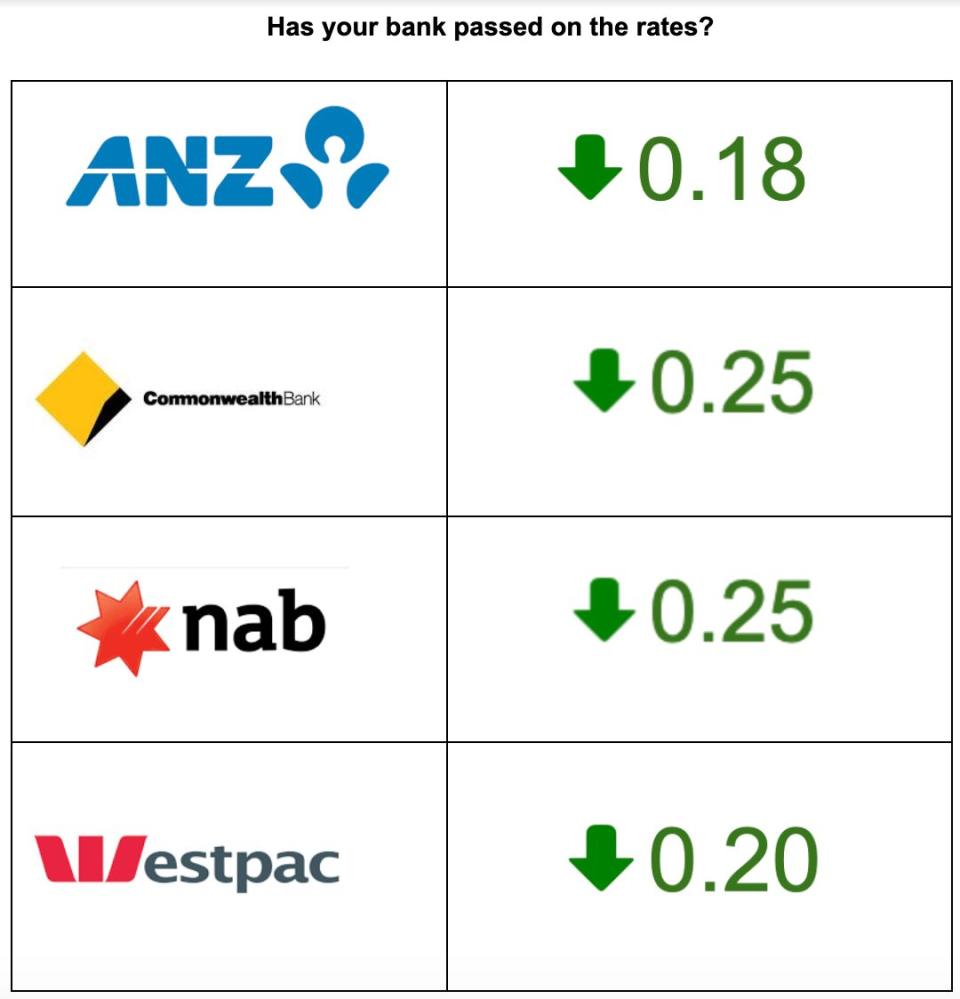

Has your bank passed the RBA interest rate cut on?

The Reserve Bank of Australia has just announced it will cut interest rates by 25 basis points, to a record low of 1.25 per cent, meaning those with variable home loans could feel some relief.

That is, if the banks choose to pass it on.

Update: ING will pass on the full rate cut, effective 25 June.

Update: Westpac is the last of the big four to pass on the rate cut, but it is only 20 basis points, effective Tuesday 18 June.

Update: NAB is the second of the big four to pass on the cut in full, effective 14 June 2019.

Update: Commonwealth Bank becomes the first of the big four to pass on the entire 25 basis point cut, effective 25 June 2019.

Update: ANZ Bank has announced it will decrease variable home loan rates by 0.18 per cent, effective 14 June 2019.

Update: RACQ Bank, Athena Home Loans and Reduce Home Loans will pass on the full rate cut.

Westpac passes on 20 basis point cut

David Lindberg, Westpac chief executive, consumer said the bank took many factors into account in making the decision.

“We are operating in a historically low interest rate environment, which creates the opportunity for home-owners to get ahead on their repayments,” he said.

“It is also a good time for first home buyers to get onto the property ladder with some of the lowest rates in the history of the Australian mortgage market available.”

NAB passes on full cut

NAB chief customer officer, consumer banking, Mike Baird said the bank strongly believed reducing rates was the right thing to do by its customers, and reflected its focus on earning trust in the community.

“This will save owner-occupier customers making principal and interest repayments on a $400,000 home loan about $62 per month or $744 per year, which will provide more money in household budgets for other expenses at a time when cost of living remains challenging,” Baird said.

CBA passes on full cut

Angus Sullivan, CBA’s group executive, retail banking services, said the bank carefully considered the RBA rate decision and the current funding environment in reaching its decision.

“By reducing the standard variable home loan rate by 0.25 per cent, the minimum required monthly repayment amount will reduce by $62 a month, based on a mortgage of $400,000 for Owner Occupiers paying Principal and Interest,” the statement said.

ANZ slammed for not passing on full cut

ANZ Group Executive, Australia retail and commercial, Mark Hand said in making their decision, they had to weigh up business performance, market conditions, and the impact on their customers.

“While we recognise some home loan customers will be disappointed, in making this decision we have needed to balance the increased cost in managing our business with our desire to provide customers with the most competitive lending and deposit rates possible,” Hand said.

But Treasurer Josh Frydenberg has slammed the bank for not passing on the full cut.

“We heard from Commissioner Hayne just months ago that the banks were putting profits before people,” he said. “Actions like this don't give the Australian people any comfort that the banks have changed their behaviour.”

Take a look at the big four banks’ new variable home loan rates

Last month’s big bank-reporting season revealed ANZ, NAB and Westpac’s total profits reached $9.1 billion for the first half of the financial year.

Related article: Reserve Bank SLASHES the cash rate to a new record low

Related article: Will the banks cut rates if the RBA does?

Related article: Here’s how the RBA rate cut will affect you, even if you don’t have a home loan

In February, the Commonwealth Bank revealed its first-half profit dropped 6 per cent, but sat at a whopping $4.6 billion.

The banks are looking healthy, which means there’s pressure on them to pass it on, but not one of the big four CEOs have yet indicated that they intend to pass on the rate cut in full.

What did NAB, Commonwealth Bank, ANZ and Westpac pass on last time the RBA cut rates (2 August, 2016)?

Variable home loan rates have only followed the RBA cash with 92 per cent accuracy since 1990, the average online savings account rate has followed the cash rate with 99 per cent accuracy.

So, the banks like to cut your savings before they cut your home loans.

Consumer advocate for Mozo, Tom Godfrey, said the big four pocketed approximately $3.6 billion in revenue by not passing on the August 2016 cut in full.

On top of that, by delaying the date at which their partial cuts in August 2016 took effect, they pulled in a whopping $7.1 million per day - $113 million in total.

“Failing to pass on any official cut in full and delaying the effective date is like turning on a money press for the big four,” Godfrey said. “Not great if you’re one of their mortgage customers.”

“It’s a scary time for savers too, there’s a very real prospect at call savings accounts could hit 0 per cent,” Godfrey said.

Why don’t they pass on the full interest rate cut?

According to RateCity’s research director, Sally Tindall, banks have been hiking rates since 2017 due to the high cost of funding, but that pressure has since dissipated.

And if you’re wondering what funding Tindall is referring to, it’s the way banks fund the cash they can lend out to you.

Around half (43 per cent) of banks’ funding comes from deposits, from both households and businesses.

The remaining funding comes from borrowing money from other banks and investors, both domestic and offshore, over long periods, and that’s called “wholesale funding”.

Those sources of wholesale funding got pretty expensive in the years since the global financial crisis because investors demanded a higher rate of return to reflect a higher degree of risk in lending their money.

Last year, the US pushed its interest rates up, which raised the benchmark borrowing rate used by big corporations like banks, so it put more pressure on the banks’ wholesale funding costs.

And, when funding costs rise, banks pass that on to consumers through lending rates, including mortgage lending rates.

But, that’s completely reversed given interest rates dropped in those wholesale markets, the RBA said.

That means that with funding costs going down, this puts some major pressure on the banks to pass on the rate to customers.

But, Tindall said it’s been a tough year for the banks in a slowing home loan market, so some may choose to hold part of the cut back.

My bank hasn’t passed the interest rate cut on, what do I do?

If you’re banking hasn’t passed on the rate cut, you should consider switching banks.

Realestate.com’s Nerida Consibee told Yahoo Finance it would be a good time to look at other loan providers.

“We haven't had a rate cut in a very long time so it's something that banks should be passing on in full,” Conisbee said.

Yahoo Finance will keep you updated once we know which banks have passed on the rate cuts.

Jessica Yun contributed to reporting.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.