News Flash: One GLI Finance Limited (LON:GLIF) Analyst Has Been Trimming Their Revenue Forecasts

Market forces rained on the parade of GLI Finance Limited (LON:GLIF) shareholders today, when the covering analyst downgraded their forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

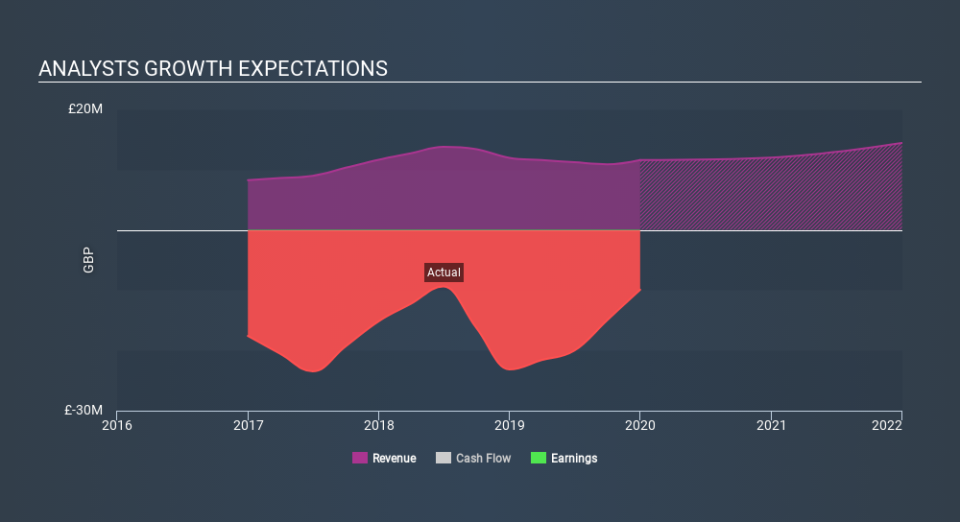

After this downgrade, GLI Finance's sole analyst is now forecasting revenues of UK£12m in 2020. This would be a credible 3.4% improvement in sales compared to the last 12 months. Prior to the latest estimates, the analyst was forecasting revenues of UK£15m in 2020. The consensus view seems to have become more pessimistic on GLI Finance, noting the measurable cut to revenue estimates in this update.

View our latest analysis for GLI Finance

Notably, the analyst has cut their price target 23% to UK£0.048, suggesting concerns around GLI Finance's valuation.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that GLI Finance's revenue growth is expected to slow, with forecast 3.4% increase next year well below the historical 11% p.a. growth over the last five years. Compare this with other companies in the same industry, which are forecast to see a revenue decline of 5.1% next year. So it's clear that despite the slowdown in growth, GLI Finance is still expected to grow meaningfully faster than the wider industry.

The Bottom Line

The clear low-light was that the analyst slashing their revenue forecasts for GLI Finance this year. They're also forecasting for revenues to perform better than companies in the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on GLI Finance after today.

As you can see, the analyst clearly isn't bullish, and there might be good reason for that. We've identified some potential issues with GLI Finance's financials, such as a short cash runway. Learn more, and discover the 3 other concerns we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.