New Jersey AG files suit accusing student loan giant Navient of 'unconscionable' practices

New Jersey Attorney General Gurbir Grewal sued Navient (NAVI) on Tuesday, alleging the student loan servicing giant deployed “deceptive, misleading” tactics to boost its profits.

The lawsuit, filed in the Superior Court in Essex County, argues that Navient is “engaged in unconscionable commercial practices, deceptive conduct, and misrepresentations when servicing thousands of New Jersey consumers’ student loans.” The lawsuit also states that Navient has violated New Jersey consumer protection laws.

“Higher education should be a pathway to success, not a road to financial ruin,” Grewal said in a press release.

Navient denies the allegations and insists that it is helping student borrowers, not taking advantage of them. “Not only are these recycled baseless allegations, Navient has consistently delivered excellent service to student loan borrowers, helping millions of people realize the benefits of higher education and successfully pay off their loans,” Navient Spokesperson Paul Hartwick told Yahoo Finance in a statement.

“As a servicer for the federal government, we have led enrollment in affordable payment plans and driven down default rates. In fact, over half of the loan portfolio we service is enrolled in income-driven repayment,” Hartwick added.

Putting ‘corporate profits above the borrower’s best interests’

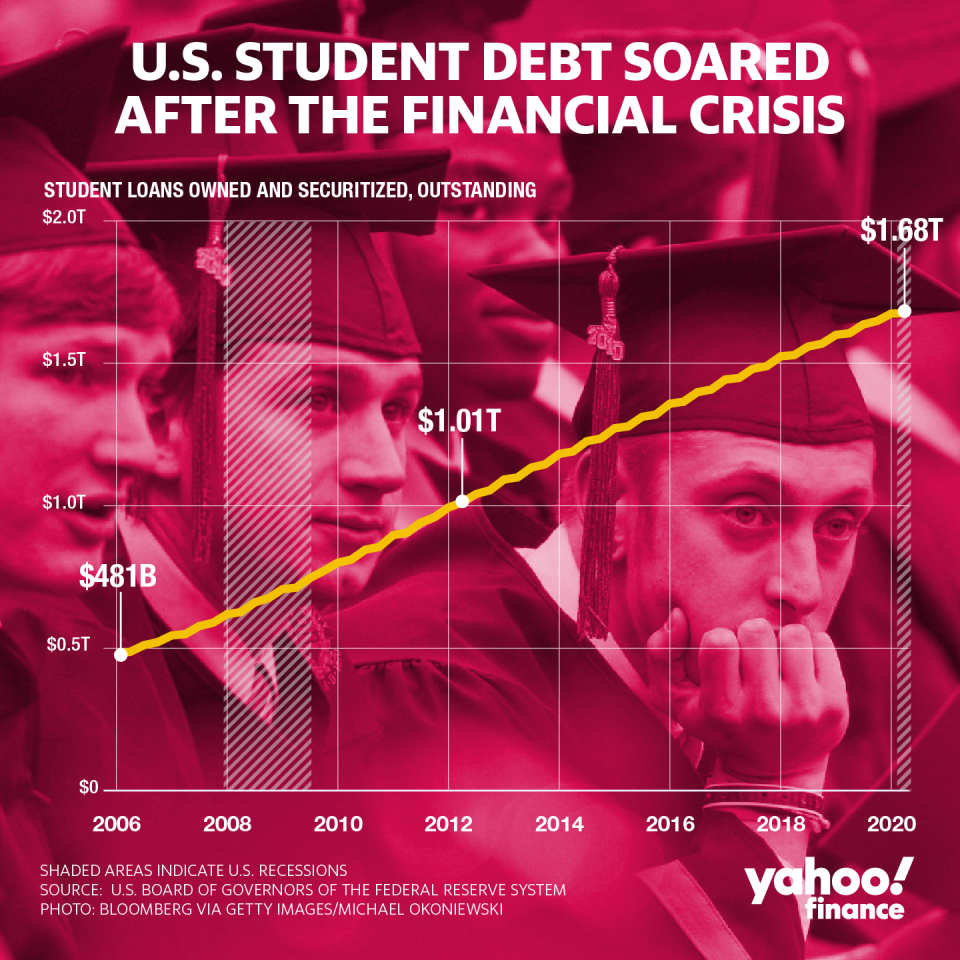

As of June, almost 170,000 borrowers in the state of New Jersey had $7 billion of their federal student loan debt serviced by Navient. The company also handles private student loans for New Jersey borrowers. Nationally, 44 million borrowers owe $1.54 trillion in student loan debt, according to the New York Fed.

Grewal said that even before the coronavirus pandemic, borrowers were struggling with their student loans because “their loan servicers put corporate profits above the borrower’s best interests.”

By suing the loan servicer, “we are taking action to hold one of the country’s largest student loan servicers accountable for abuses that made New Jersey borrowers worse off,” he added.

The case follows an investigation by the state’s Division of Consumer Affairs. The lawsuit stated that the division has “received, directly and indirectly, approximately 1,000 consumer complaints from New Jersey borrowers regarding Navient's business practices related to the servicing of student loans.”

Borrowers complained of being steered into forbearance instead of income-driven repayment plans. Unsealed court documents from last October reveal the same behavior at the national level; forbearance was being pushed internally as an “optimal solution,” a senior director at Sallie Mae, Navient’s former parent company, wrote in a 2010 internal memo.

They also complained of not being informed of the right deadline to complete annual paperwork to stay on those repayment plans, of facing major hurdles to have loan co-signers released from a loan, and also being given wrong information about how much to pay to have a loan exit delinquency status.

Mike Pierce of the Student Borrower Protection Center, a D.C. nonprofit organization, noted in a tweet that Grewal isn’t the only one taking on the student loan giant.

[BREAKING] New Jersey just sued @Navient for cheating #studentloan borrowers out of their rights. NJ is lucky to have the AG and his team fighting to #protectborrowers.

Grewal joins WA, IL, CA, PA & MS as the *SIXTH* state to sue the embattled student loan giant, along w/ @CFPB. https://t.co/PDcTE4PJP4— Mike Pierce (@millennial_debt) October 20, 2020

—

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

Internal memo highlights Navient's alleged hidden agenda with student loan borrowers

Trump v. Biden: Here's what's at stake for student loan borrowers

'The federal government is AWOL’ on student loan protections, California attorney general says

Warren and Schumer urge student debt cancellation of up to $50,000 for all federal borrowers

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.