NetDragon Websoft Holdings Limited (HKG:777) Full-Year Results Just Came Out: Here's What Analysts Are Forecasting For This Year

It's been a good week for NetDragon Websoft Holdings Limited (HKG:777) shareholders, because the company has just released its latest full-year results, and the shares gained 8.3% to HK$19.62. Revenues of CN¥5.8b were in line with forecasts, although statutory earnings per share (EPS) came in below expectations at CN¥1.52, missing estimates by 3.3%. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on NetDragon Websoft Holdings after the latest results.

See our latest analysis for NetDragon Websoft Holdings

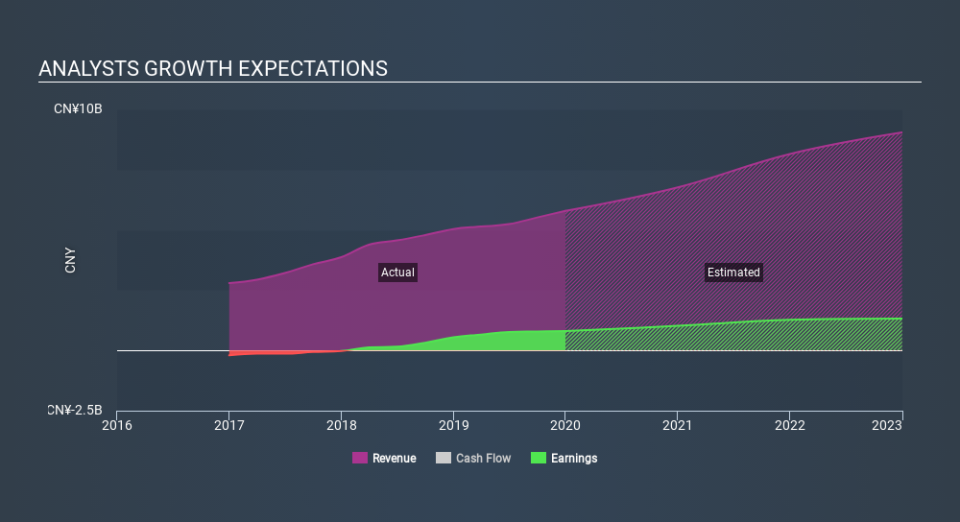

Following the latest results, NetDragon Websoft Holdings' seven analysts are now forecasting revenues of CN¥6.77b in 2020. This would be a decent 17% improvement in sales compared to the last 12 months. Per-share earnings are expected to leap 24% to CN¥1.89. Before this earnings report, the analysts had been forecasting revenues of CN¥6.94b and earnings per share (EPS) of CN¥1.88 in 2020. The consensus seems maybe a little more pessimistic, trimming their revenue forecasts after the latest results even though there was no change to its EPS estimates.

The average price target was steady at CN¥26.92 even though revenue estimates declined; likely suggesting the analysts place a higher value on earnings. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values NetDragon Websoft Holdings at CN¥32.89 per share, while the most bearish prices it at CN¥22.38. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the NetDragon Websoft Holdings' past performance and to peers in the same industry. It's pretty clear that there is an expectation that NetDragon Websoft Holdings' revenue growth will slow down substantially, with revenues next year expected to grow 17%, compared to a historical growth rate of 33% over the past five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 17% next year. So it's pretty clear that, while NetDragon Websoft Holdings' revenue growth is expected to slow, it's expected to grow roughly in line with the industry.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. Sadly, they also downgraded their sales forecasts, but the business is still expected to grow at roughly the same rate as the industry itself. With that said, earnings are more important to the long-term value of the business. The consensus price target held steady at CN¥26.92, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple NetDragon Websoft Holdings analysts - going out to 2022, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with NetDragon Websoft Holdings , and understanding it should be part of your investment process.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.