The Neodecortech (BIT:NDT) Share Price Is Up 15% And Shareholders Are Holding On

We believe investing is smart because history shows that stock markets go higher in the long term. But if you choose that path, you're going to buy some stocks that fall short of the market. Unfortunately for shareholders, while the Neodecortech S.p.A. (BIT:NDT) share price is up 15% in the last year, that falls short of the market return. Neodecortech hasn't been listed for long, so it's still not clear if it is a long term winner.

See our latest analysis for Neodecortech

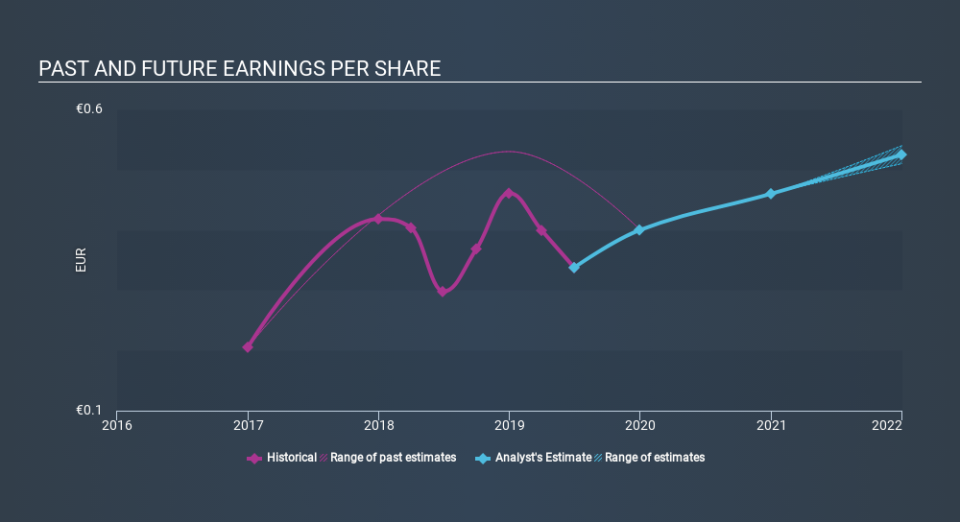

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Neodecortech grew its earnings per share (EPS) by 13%. This EPS growth is reasonably close to the 15% increase in the share price. This makes us think the market hasn't really changed its sentiment around the company, in the last year. We don't think its coincidental that the share price is growing at a similar rate to the earnings per share.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Neodecortech has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Neodecortech will grow revenue in the future.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Neodecortech's TSR for the last year was 20%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're happy to report that Neodecortech are up 20% over the year (even including dividends) . While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 24%. That's a lot better than the more recent three month gain of 1.1%, implying that share price has plateaued recently, for now. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Neodecortech , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.