How Much Did Mesa Air Group's(NASDAQ:MESA) Shareholders Earn From Share Price Movements Over The Last Year?

Even the best stock pickers will make plenty of bad investments. Anyone who held Mesa Air Group, Inc. (NASDAQ:MESA) over the last year knows what a loser feels like. In that relatively short period, the share price has plunged 57%. We wouldn't rush to judgement on Mesa Air Group because we don't have a long term history to look at. More recently, the share price has dropped a further 17% in a month.

See our latest analysis for Mesa Air Group

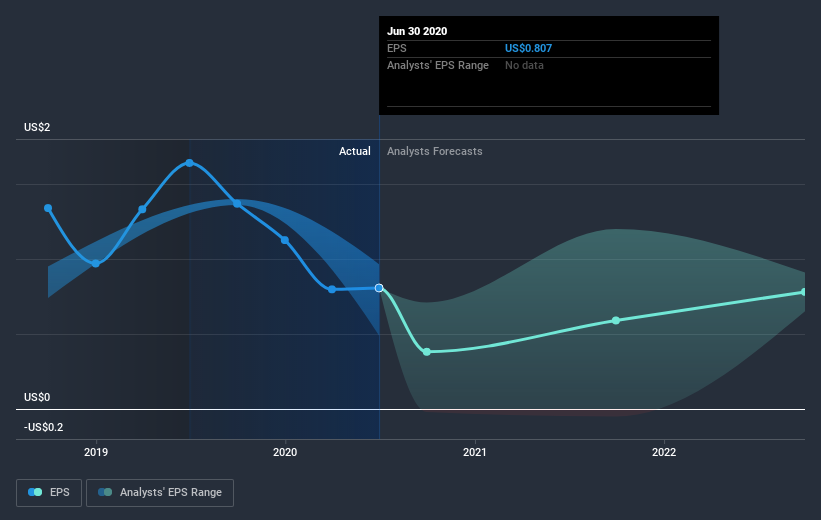

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, Mesa Air Group had to report a 51% decline in EPS over the last year. This proportional reduction in earnings per share isn't far from the 57% decrease in the share price. Given the lower EPS we might have expected investors to lose confidence in the stock, but that doesn't seemed to have happened. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Mesa Air Group's earnings, revenue and cash flow.

A Different Perspective

Given that the market gained 15% in the last year, Mesa Air Group shareholders might be miffed that they lost 57%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 13%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Mesa Air Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Mesa Air Group (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.