Some Medicskin Holdings (HKG:8307) Shareholders Have Taken A Painful 85% Share Price Drop

As every investor would know, not every swing hits the sweet spot. But really bad investments should be rare. So spare a thought for the long term shareholders of Medicskin Holdings Limited (HKG:8307); the share price is down a whopping 85% in the last three years. That'd be enough to cause even the strongest minds some disquiet. The more recent news is of little comfort, with the share price down 57% in a year. Shareholders have had an even rougher run lately, with the share price down 50% in the last 90 days.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Medicskin Holdings

Because Medicskin Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Medicskin Holdings's revenue dropped 7.7% per year. That's not what investors generally want to see. The share price fall of 46% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

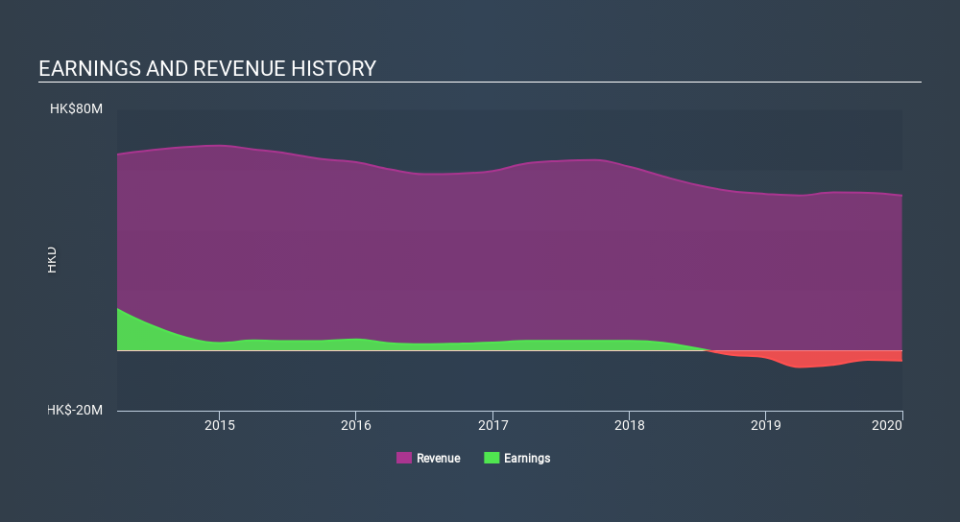

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Medicskin Holdings's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Medicskin Holdings's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Medicskin Holdings's TSR, which was a 81% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 20% in the twelve months, Medicskin Holdings shareholders did even worse, losing 50%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 20% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Medicskin Holdings (at least 2 which don't sit too well with us) , and understanding them should be part of your investment process.

But note: Medicskin Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.