Market Participants Recognise WestBond Enterprises Corporation's (CVE:WBE) Earnings Pushing Shares 26% Higher

Despite an already strong run, WestBond Enterprises Corporation (CVE:WBE) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 167% following the latest surge, making investors sit up and take notice.

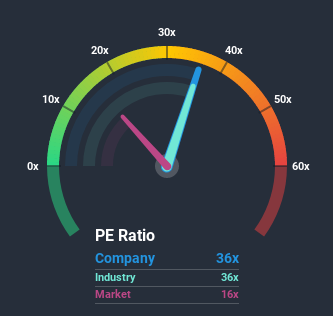

After such a large jump in price, WestBond Enterprises' price-to-earnings (or "P/E") ratio of 36x might make it look like a strong sell right now compared to the market in Canada, where around half of the companies have P/E ratios below 16x and even P/E's below 8x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

The earnings growth achieved at WestBond Enterprises over the last year would be more than acceptable for most companies. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for WestBond Enterprises

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on WestBond Enterprises' earnings, revenue and cash flow.

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as WestBond Enterprises' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 20%. The strong recent performance means it was also able to grow EPS by 107% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 9.3% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why WestBond Enterprises is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Shares in WestBond Enterprises have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that WestBond Enterprises maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 4 warning signs for WestBond Enterprises that you should be aware of.

If these risks are making you reconsider your opinion on WestBond Enterprises, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.