Low Shredding Volumes to Mar Iron Mountain (IRM) Q2 Revenues

Iron Mountain Incorporated IRM is set to release second-quarter 2020 results on Aug 6, before market open. The company’s quarterly funds from operations (FFO) per share and revenues are expected to have declined year over year.

In the last reported quarter, this real estate investment trust (REIT) posted normalized FFO per share of 59 cents, beating the Zacks Consensus Estimate of 45 cents. Results reflected strength in the company’s core storage business.

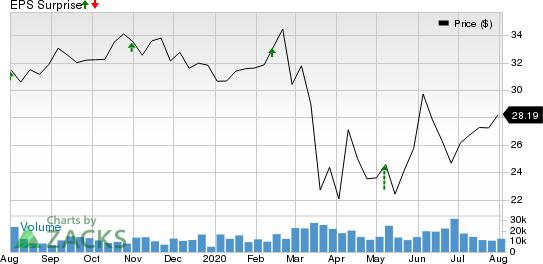

Over the preceding four quarters, it surpassed the FFO per share estimates on all four occasions, the average positive surprise being 11.31%. This is depicted in the graph below:

Iron Mountain Incorporated Price and EPS Surprise

Iron Mountain Incorporated price-eps-surprise | Iron Mountain Incorporated Quote

Let’s see how things are shaping up prior to this announcement.

The massive work-from-home environment due to the coronavirus pandemic is expected to have driven the material demand for highly connected data-center space from cloud and Internet customers. This sudden incremental network demand, stemming from an increase in remote working, is likely to have buoyed Iron Mountain’s data-center business.

In fact, in early June, the company signed a 27-megawatt (MW) data-center lease deal for its new FRA-1 data center in Frankfurt, Germany, which is currently under construction. With this, it already surpassed its full-year leasing plan of 15-20 MWs. Moreover, the Zacks Consensus Estimate for second-quarter revenues from the global data-center business is pinned at $68 million and indicates 9.7% growth from the year-ago figure of $62 million.

Further, with strong box retention, Iron Mountain enjoys a steady stream of recurring revenues from its core storage and record management businesses. This is likely to have driven profitability and cash for the company in the second quarter.

However, there has been a slowdown in certain new sales activity at its storage business. Management is of the view that low economic activity instead of the fact that remote working is likely to have impacted physical storage business volumes. This is expected to have hindered the company’s storage rental revenues and net operating income (NOI).

In fact, the consensus estimate for quarterly storage rental revenues is pinned at $674 million, indicating a sequential decline of 1.5%. Also, the estimate for storage NOI of $541 million compares unfavorably when compared with the prior quarter’s figure of $549 million.

Also, the pandemic has taken a toll on Iron Mountain’s service business (representing 20% of revenues) due to lower economic activity and remote working that have resulted in low demand for pick-up or drop off of boxes in the June-end quarter. In fact, the company identified a year-over-year decline of 45-50% in retrieval and refile activity during April.

Further, in its secure destruction segment, shred volumes in April witnessed a 25-30% year-over-year decline due to limited pickups. Amid these, Iron Mountain expects a 40% year-over-year decline in second-quarter service activity.This is concerning as the service segment was already reeling with low recycled paper prices.

In fact, the consensus estimate for second-quarter service revenues is pinned at $236 million and indicates a decline of 39% from the prior-quarter reported figure.

Lastly, prior to the second-quarter earnings release, the Zacks Consensus Estimate for the company’s second-quarter FFO per share remained unchanged at 42 cents over the past month. It also represents a year-over-year decline of 22.22%. Moreover, revenues for the April-June period are pinned at $918.3 million and the figure indicates a 13.9% year-over-year decline.

Earnings Whispers

Our proven model does not conclusively predict a surprise in terms of FFO per share for Iron Mountain this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a FFO beat. That is not the case here, as you will see below.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Iron Mountain’s Earnings ESP is 0.00%.

Zacks Rank: The company currently carries a Zacks Rank of 3.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

Healthcare Trust of America, Inc. HTA, set to report quarterly numbers on Aug 6, currently has an Earnings ESP of +0.96% and carries a Zacks Rank of 3.

Public Storage PSA, slated to release results on Aug 5, has an Earnings ESP of +0.41% and carries a Zacks Rank of 3 at present.

National Storage Affiliates Trust NSA, scheduled to announce earnings figures on Aug 6, has an Earnings ESP of +0.44% and holds a Zacks Rank of 3 currently.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Storage (PSA) : Free Stock Analysis Report

Iron Mountain Incorporated (IRM) : Free Stock Analysis Report

Healthcare Trust of America, Inc. (HTA) : Free Stock Analysis Report

National Storage Affiliates Trust (NSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research