Should Les Hôtels Baverez (EPA:ALLHB) Be Disappointed With Their 28% Profit?

Investors can buy low cost index fund if they want to receive the average market return. But in any diversified portfolio of stocks, you'll see some that fall short of the average. That's what has happened with the Les Hôtels Baverez S.A. (EPA:ALLHB) share price. It's up 28% over three years, but that is below the market return. Zooming in, the stock is actually down 8.3% in the last year.

See our latest analysis for Les Hôtels Baverez

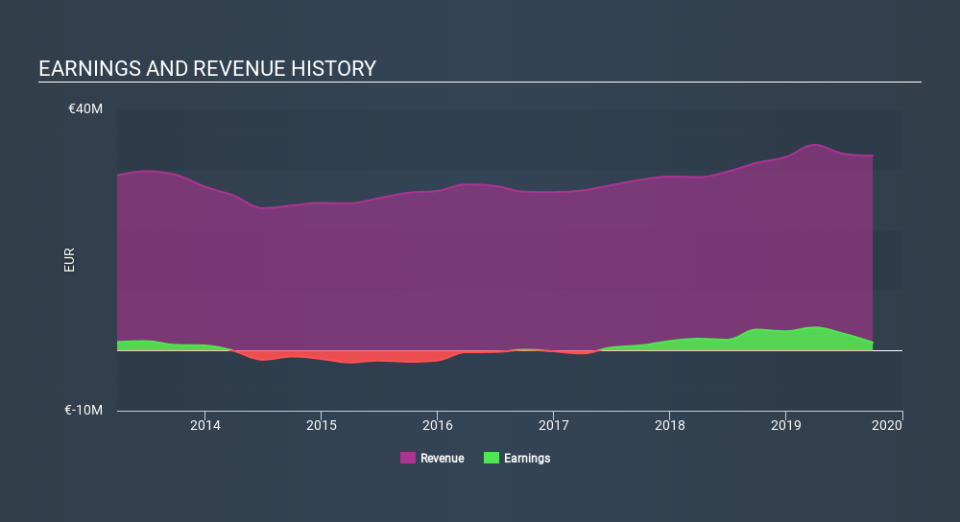

Given that Les Hôtels Baverez only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Les Hôtels Baverez's revenue trended up 8.8% each year over three years. That's pretty nice growth. The annual gain of 8.5% over three years is better than nothing, but hardly impresses. Arguably, that means, the market (previously) expected stronger growth from the company. However, if you can reasonably expect profits in the next few years, this stock might belong on your watchlist.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Les Hôtels Baverez shareholders are down 8.0% for the year (even including dividends) , but the market itself is up 21%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 3.7% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Les Hôtels Baverez better, we need to consider many other factors. Take risks, for example - Les Hôtels Baverez has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.