Investors are going mad, and tech sector is ground zero

I’ve been saying it for some time. And I’ll say it again today: The tech sector is ground zero for this building stock market bubble.

It’s where the growth is. It’s where the future is. And it’s where investors are increasingly congregating.

A Wall Street Journal article headlined Why Mess With a Winning Strategy? Investors Bet on Tech, says it all.

The article states:

Investors have given up bargain hunting so far this year.

Instead, they are piling into shares of some of the market’s biggest winners: so-called growth stocks, shares of companies that promise rapidly increasing profits and revenue.

They remain as hungry as ever for shares of software providers and cloud-computing companies, flocking to heavyweights like MicrosoftCorp., Apple Inc., Amazon.com Inc. and Google parent Alphabet Inc. These stocks are sitting on double-digit gains in 2020 and have powered 45% of the S&P 500’s total return, which reflects price changes and dividend payments, according to S&P Dow Jones Indices.

In trying to judge where markets are right now, these articles are gold. They tell a story of investors ‘giving up’ and chasing performance. They give you a good insight into the psychology of the marketplace.

What is the psychology?

Put simply, it’s common knowledge that growth stocks are the only game in town. Therefore, you have to buy because, well, that’s what everyone else is doing.

But here’s the real kicker from the article. It tells you a lot about the self-delusion investors inflict on themselves as the cycle enters its later stages.

“Investors believe they’re better positioned to weather any economic storm,” said Brent Schutte, chief investment strategist at Northwestern Mutual Wealth Management Co., speaking of growth stocks. “Even if there’s a recession, people will keep using Facebook.”

Just because investors believe it, it doesn’t mean they’re right. Belief in things that just aren’t true always get investors into trouble.

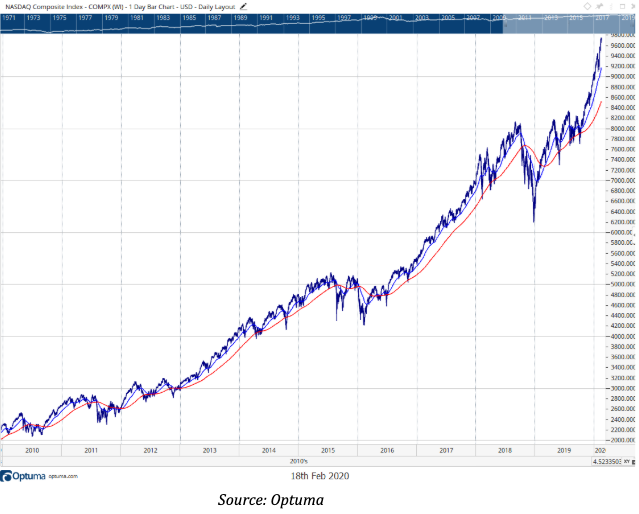

This is how psychology takes hold. Investors tell themselves things that aren’t true. How else can you justify confidently investing in tech stocks after a multi-year run that looks like this:

That’s a chart of the NASDAQ. Since the low in October last year, it has surged higher, barely pausing for breath.

Is it a top?

No one knows, of course. And anyway, this is not about predicting tops. It’s about pointing out shifts from rational to irrational behaviour. When you see things in this light, you can adjust your strategy to avoid succumbing to crowd-like behaviour.

For example, believing that buying Facebook is safe regardless of price — because people will still use it in a recession — is a delusion.

Let me show you what I mean…

Consensus earnings estimates forecast that Facebook will increase net profit 27% in FY20, 19% in FY21 and 18% in FY22. On these numbers, the stock trades on a price-to-earnings (P/E) multiple of 23.7, 19.8 and 16.9 respectively.

These are bull market multiples on bull market earnings estimates. To believe that these earnings and multiples would hold up in a recession is pure fantasy.

So good luck to all those who believe that Facebook is a defensive play.

The tech delusion has made its way to Australia too. This one is not so obvious. And maybe I’m revealing my bias here too. But I thought this snippet from the Australian Financial Review was interesting to say the least:

Atlassian will build a $1 billion-plus concrete-and-timber tower next to Sydney's Central Station, as the flagship project in a NSW government-backed technology precinct that will eventually link Ultimo with Redfern on the CBD's southern edge.

"We too believe in the power of place, the power of geography, and the power of community," Mr Farquhar [Altassian co-founder] told the BE Sydney Ambassador Dinner.

"That’s the vision behind our plan to build a vibrant technology precinct at Central Station, with Atlassian as the anchor tenant.

"We believe that Sydney has the potential to be of one of the world’s leading technology cities and the creation of a tech precinct sends a loud signal – not only to Australia, but to the rest of the world – that we’re in the race to take a slice of the world’s most valuable market."

Is this tech vision? Or tech hubris?

Only time will tell. But I do know that talk of a $1 billion building to underpin a new tech precinct in a city with the worlds most expensive real estate doesn’t happen at the start of a cycle.

Again, this is not to try and tell you these anecdotes are a definitive sign of a top. They’re just ongoing evidence of a divergence between prices and fundamentals.

Whether this divergence continues depends on a number of factors. None of which I can accurately guess at or forecast.

But if history is any guide, and it usually is, it tells you that such divergences tend to gather steam.

So, expect the party to continue. Expect it to get louder. But don’t get too drunk. Keep a close eye on the exits.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.