Investors Who Bought Orchard Funding Group (LON:ORCH) Shares A Year Ago Are Now Down 21%

The simplest way to benefit from a rising market is to buy an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Orchard Funding Group plc (LON:ORCH) share price slid 21% over twelve months. That's disappointing when you consider the market returned 18%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 11% in three years. The last week also saw the share price slip down another 6.4%.

Check out our latest analysis for Orchard Funding Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the Orchard Funding Group share price fell, it actually saw its earnings per share (EPS) improve by 8.1%. It's quite possible that growth expectations may have been unreasonable in the past.

It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

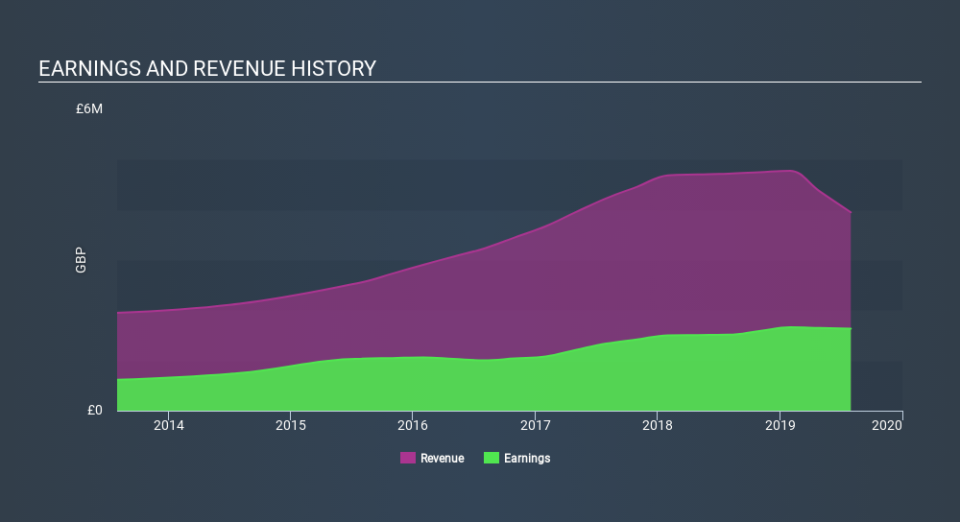

We don't see any weakness in the Orchard Funding Group's dividend so the steady payout can't really explain the share price drop. In fact, it seems more likely that the revenue fall of 16% in the last year is the worry. So it seems likely that the weak revenue is making the market more cautious about the stock.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Orchard Funding Group's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Orchard Funding Group, it has a TSR of -18% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

The last twelve months weren't great for Orchard Funding Group shares, which cost holders 18% , including dividends , while the market was up about 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 0.8% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Orchard Funding Group that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.