The Australians about to fall off $75 billion cliff

Australian homeowners are headed for a $75 billion home loan default when the government’s wage subsidy scheme ends in a few months, new research shows.

Almost half of all homeowners (43 per cent) will struggle to meet their loan repayments after their JobKeeper payments end, according to Mozo.

And, with the Australian Banking Association reporting that $175.5 billion in loans has been paused due to Covid-19 hardship, that means the potential default figure could be up to a whopping $75 billion.

“As a nation of mortgage holders we look set to walk off a financial cliff when government and industry support programs end,” Mozo spokesperson Tom Godfrey said.

“With many Australians finding themselves out of work and many more having to accept reduced hours, JobKeeper and the banks’ mortgage holidays are critical in ensuring people can stay in their homes.”

The research also found 53 per cent of mortgage holders were worried they could be forced to sell their home if they’re unable to meet their repayments in six months.

What’s more, 38 per cent of Aussies on JobKeeper said the payment wasn’t enough to cover their current bills, let alone when the payments would end in September.

“It’s clear the Federal Government’s JobKeeper payments are proving a vital lifeline for many paying down their home loans. But when these payments end and the banks’ eventually turn off the hardship support tap, the mortgage market could start to crumble,” Godfrey said.

Home loan rates at record lows

The report comes as the Reserve Bank of Australia meets to discuss the official cash rate on Tuesday, which is expected to remain at 0.25 per cent.

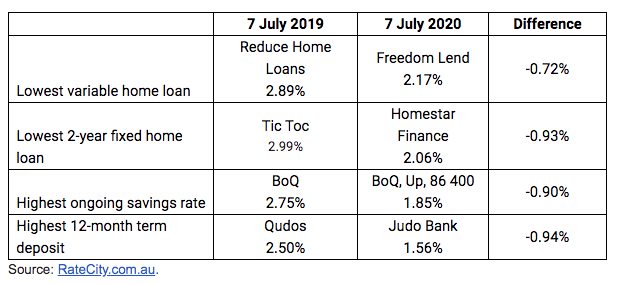

Here are the current market-leading rates for new bank customers:

According to home loan rate comparison site RateCity, rates have been decreasing since the last cash rate cut in March.

“It’s been a record-busting month for mortgages as lenders leapfrog each other in a bid to offer the lowest-rate home loans,” research director at RateCity, Sally Tindall, said.

“With refinancing on the rise, lenders have to keep whittling down their rates if they want to be in contention for these borrowers.”

But the rate cuts have been bad news for savers, Tindall said.

“Competition in savings rates is near non-existent at the moment, particularly among the bigger banks who have seen their deposit books increase during Covid-19,” Tindall said.

“We’re unlikely to see any real turnaround in savings rates for months, or more likely years to come,” she said.

Are you a millennial or Gen Z-er interested in joining a community where you can learn how to take control of your money? Join us at The Broke Millennials Club on Facebook!