Here's Why I Think Tiangong International (HKG:826) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Tiangong International (HKG:826), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Tiangong International

How Fast Is Tiangong International Growing Its Earnings Per Share?

In the last three years Tiangong International's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, Tiangong International's EPS soared from CN¥0.094 to CN¥0.13, over the last year. That's a impressive gain of 35%.

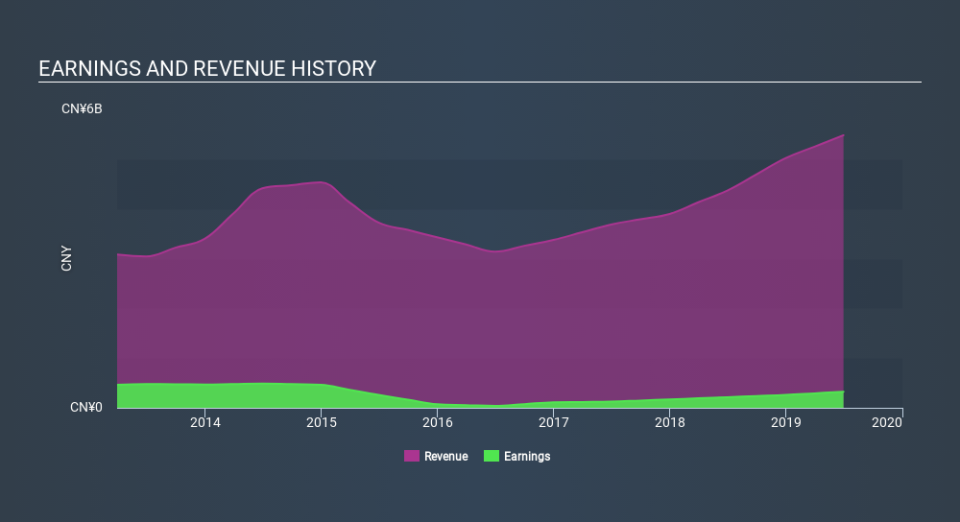

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Tiangong International's EBIT margins were flat over the last year, revenue grew by a solid 25% to CN¥5.5b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Tiangong International Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for Tiangong International, in the last year, is that a certain insider has buying shares with ample enthusiasm. Specifically, in one large transaction Chief Investment Officer Zefeng Zhu paid HK$25m, for stock at HK$2.48 per share. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

Along with the insider buying, another encouraging sign for Tiangong International is that insiders, as a group, have a considerable shareholding. Notably, they have an enormous stake in the company, worth CN¥2.4b. Coming in at 32% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Suojun Wu, is paid less than the median for similar sized companies. For companies with market capitalizations between CN¥2.8b and CN¥11b, like Tiangong International, the median CEO pay is around CN¥3.2m.

The CEO of Tiangong International only received CN¥805k in total compensation for the year ending December 2018. That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Tiangong International To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Tiangong International's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So it's fair to say I think this stock may well deserve a spot on your watchlist. Now, you could try to make up your mind on Tiangong International by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Tiangong International, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.