If You Had Bought Jiyi Household International Holdings (HKG:1495) Stock A Year Ago, You'd Be Sitting On A 23% Loss, Today

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Jiyi Household International Holdings Limited (HKG:1495) shareholders over the last year, as the share price declined 23%. That's well bellow the market return of -6.3%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 10% in three years. More recently, the share price has dropped a further 11% in a month.

See our latest analysis for Jiyi Household International Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Jiyi Household International Holdings share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth.

By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, last year. But looking to other metrics might better explain the share price change.

Jiyi Household International Holdings's revenue is actually up 17% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

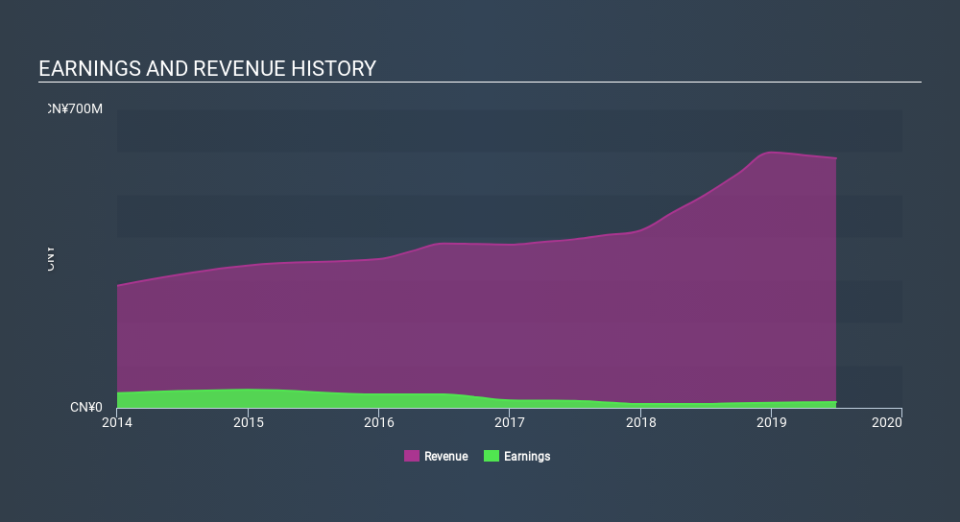

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Jiyi Household International Holdings's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Jiyi Household International Holdings hasn't been paying dividends, but its TSR of -23% exceeds its share price return of -23%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Jiyi Household International Holdings shareholders are down 23% for the year, falling short of the market return. Meanwhile, the broader market slid about 6.3%, likely weighing on the stock. Shareholders have lost 2.6% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Jiyi Household International Holdings better, we need to consider many other factors. Be aware that Jiyi Household International Holdings is showing 4 warning signs in our investment analysis , and 2 of those are a bit concerning...

Jiyi Household International Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.