Greenlane Holdings, Inc. (NASDAQ:GNLN) Consensus Forecasts Have Become A Little Darker Since Its Latest Report

It's been a sad week for Greenlane Holdings, Inc. (NASDAQ:GNLN), who've watched their investment drop 19% to US$1.71 in the week since the company reported its annual result. It was an okay result overall, with revenues coming in at US$185m, roughly what the analysts had been expecting. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

See our latest analysis for Greenlane Holdings

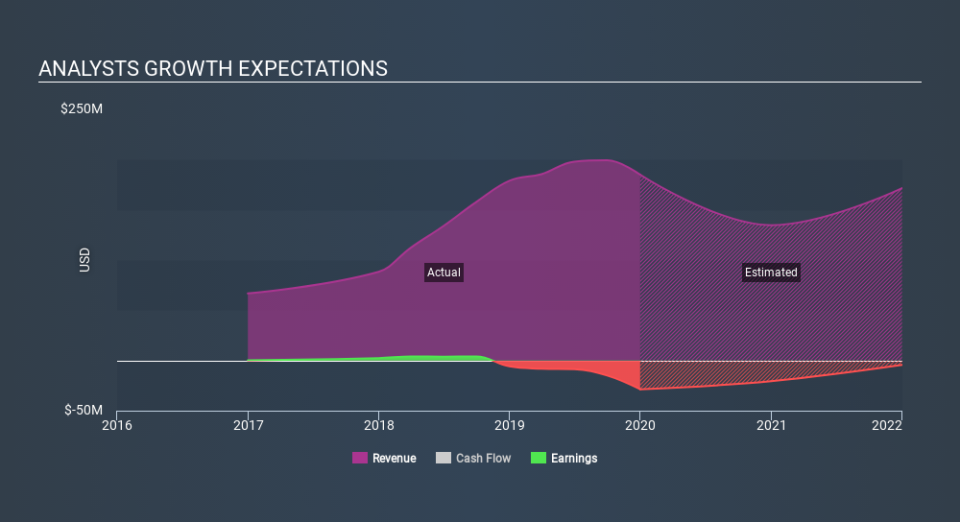

Following the recent earnings report, the consensus from five analysts covering Greenlane Holdings is for revenues of US$134.7m in 2020, implying a concerning 27% decline in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 61% to US$1.09. Yet prior to the latest earnings, the analysts had been forecasting revenues of US$183.0m and losses of US$0.42 per share in 2020. There's been a definite change in sentiment in this update, with the analysts administering a notable cut to next year's revenue estimates, while at the same time increasing their loss per share forecasts.

The average price target fell 43% to US$4.80, implicitly signalling that lower earnings per share are a leading indicator for Greenlane Holdings' valuation. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Greenlane Holdings, with the most bullish analyst valuing it at US$8.00 and the most bearish at US$3.00 per share. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how analysts think this business will perform. As a result it might not be a great idea to make decisions based on the consensus price target, which is after all just an average of this wide range of estimates.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that sales are expected to reverse, with the forecast 27% revenue decline a notable change from historical growth of 33% over the last three years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 2.4% next year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Greenlane Holdings is expected to lag the wider industry.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at Greenlane Holdings. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Greenlane Holdings analysts - going out to 2021, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Greenlane Holdings , and understanding these should be part of your investment process.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.