Four companies sold for $1 that are now worth a fortune

This year Australian media giant Nine Entertainment sold its New Zealand news company Stuff for just $1.

Stuff chief executive Sinead Boucher purchased the business from Nine, which had been trying to offload it ever since acquiring it from its merger with Fairfax Media two years ago.

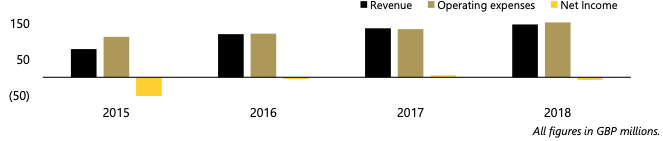

In New Zealand, eyebrows were raised as to why a popular news site that had NZ$400 million (AU$375 million) of revenue just in 2015 could be just given away like that.

"The answer is all about the cash flows of the business," said Clare Capital managing partner Mark Clare.

"It strongly appears that Stuff is on a trajectory to constantly losing money, without a clear path back to profitability. Businesses in this situation aren’t worth much, if anything."

Unfortunately news and media companies around the world have suffered from falling revenues with no clear way out of the downward spiral.

Clare said Nine, without selling the business, faced performing an expensive restructure of the Kiwi arm – a task that it had no appetite for while it had its own problems in Australia.

But a $1 sale doesn't necessarily ring the death knell.

There are many examples of businesses sold off for nothing, then revived to later be valued at millions or even billions of dollars.

Here are four examples, according to Clare Capital:

Newsweek: sold for US$1

US weekly news magazine Newsweek was founded in 1933 but was in financial strife by 2008.

Its parent company Washington Post sold it in 2010 to audio engineering trailblazer Sidney Harman for US$1.

For the bargain price, Harman took on liabilities of more than US$47 million. While he would pass away the year after the sale, reforms had already started, culminating in the famous magazine stopping its print edition in 2012.

"IBT Media purchased Newsweek in 2013, making significant changes and turning the business to profitability in late 2014," said Clare.

"Using IBT's resources, content output was increased while still retaining quality journalism."

The print magazine actually returned in 2014, but with a higher price tag. Now the publication has an estimated readership of 100,000.

Reader's Digest: sold for £1

The iconic magazine, which was once the biggest selling rag in the entire world, was handed to entrepreneur Mike Luckwell in 2014 for just one pound.

Luckwell changed the publication's shift from print to digital and managed to turn its fortunes around.

"Currently the publication has over 24 million readers of both its printed and digital publications and can be found in over 70 different countries," Clare said.

Chelsea Football Club: sold for £1

Now one of the powerhouses in English soccer, Chelsea was facing ruin in the early 1980s after a long-running battle with property developers who tried to evict them from their London stadium.

In 1982, the club was sold to businessman Ken Bates for one pound.

While Bates resolved the real estate issue, he was also instrumental in the formation of the Premier League in the early 1990s which made UK soccer clubs multi-million dollar businesses with massive television deals.

"In 2003, Ken Bates sold Chelsea to Roman Abramovich for £140 million," said Clare.

"Chelsea is [now] estimated by Forbes to be worth over £2.5 billion."

Lotus Formula 1 Team: sold for £1

The famous Lotus brand had lost its lustre by 2015 when Renault purchased the Formula One racing team for one pound.

The team, which is now known as the Renault F1 team, managed to increase its revenue while keeping a lid on its costs. Within one year the team was breaking even.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.