Ford's (F) Q3 Earnings & Sales Surpass Estimates, Up Y/Y

Ford Motor Company F reported third-quarter 2020 adjusted diluted earnings of 65 cents per share, comfortably outpacing the Zacks Consensus Estimate of 22 cents.

This outperformance resulted from higher-than-anticipated automotive sales in North America and Europe. Revenues from automotive sales in North America and Europe came in at $25,300 million and $5,700 million, respectively, beating the Zacks Consensus Estimate of $24,307 million and $5,562 million. Moreover, the bottom line surged 91.2% year on year from the year-ago quarter’s profit of 34 cents per share.

The Dearborn-based automaker delivered solid financial results in the third quarter through a combination of robust operating execution and focus on its strengths in high-demand, profitable vehicles, along with a reversal of the adverse impact of the coronavirus pandemic.

During the September-end quarter, the company reported adjusted EBIT of $3,644 million, as against the $1,793 million recorded in the corresponding period of 2019. Also, the U.S. auto giant reported net profit of $2,385 million, significantly increasing from the prior-year level of $425 million.

Ford registered revenues of $37,501 million in the third quarter, up from the year-ago period’s $36,990 million.

During the reported quarter, the company generated automotive revenues of $34,707 million. The figure outpaced the Zacks Consensus Estimate of $32,700 million as well as came in higher than the prior-year quarter’s $33,931 million.

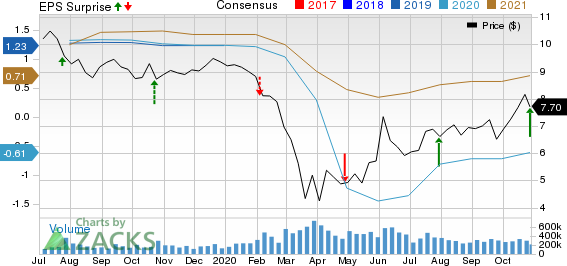

Ford Motor Company Price, Consensus and EPS Surprise

Ford Motor Company price-consensus-eps-surprise-chart | Ford Motor Company Quote

Segmental Performance

For the third quarter, revenues from Ford Credit declined 8.9% year over year to $2,774 million. Revenues from Ford Mobility came in at $20 million, up from the $14 million recorded in the third quarter of 2019.

During the July-September quarter, wholesale volume in the Ford Automotive segment slid 5% from the prior-year period to 1,178,000. The segment recorded EBIT of $2,644 million, higher than the year-ago profit of $1,329 million.

In North America, revenues increased 8% year on year to $25.3 billion during the reported quarter. Wholesale volume rose 2% from the year-earlier quarter to 651,000 units. Further, EBIT was $3,178 million compared with the EBIT of $2,011 million witnessed in the year-ago quarter.

In South America, revenues plunged 39% year over year to $0.6 billion during the third quarter. Wholesale volume plummeted 39% from the year-ago quarter to 48,000 units. The region reported a negative EBIT of $108 million, narrower than the prior-year loss of $165 million.

In Europe, revenues fell 10% year on year to $5.7 billion during the September-end quarter. Wholesale volume slipped 20% from the year-ago period to 239,000 units. The region registered a negative EBIT of $440 million, wider than the prior-year loss of $143 million.

In China, revenues climbed 15% year over year to $1 billion during the reported quarter. Further, wholesale volume increased 22% from the prior-year figure to 164,000 units. The region reported a negative EBIT of $58 million, narrower than the year-ago loss of $281 million.

In the International Markets Group, revenues dropped 11% from the year-ago figure to $2 billion. Wholesale volume dipped 18% from the prior-year level to 76,000 units. However, the region reported EBIT of $72 million comparing favorably with the loss of $93 million witnessed in the prior-year quarter.

Financial Position

The company reported third-quarter adjusted free cash flow of $6,302 million. Ford had cash and cash equivalents of $24,263 million as of Sep 30, 2020, compared with $17,504 million on Dec 31, 2019. Automotive long-term debt increased to $22,363 million as of Sep 30, 2020 compared with $13,233 million on Dec 31, 2019.

Outlook

Ford has issued the fourth-quarter guidance. The company plans to launch three anticipated, all-new game-changing vehicles in the ongoing quarter. The models slated to be rolled out are 2021 F-150, all electric Mustang Mach-E, and Bronco Sport — first of new Bronco family of products. For this, the company will temporarily lower wholesale shipments of F-150 to about 100,000 units. Also, it expects to incur sequentially higher structural and other costs related to the manufacturing launches of Mustang Mach-E and Bronco Sport. Ford also expects to generate sequentially lower EBT from Ford Credit.

Ford anticipates fourth-quarter adjusted EBIT to be between break-even and a $500-million loss, down from both the third quarter and the year-ago period. Based on this guidance, the company now expects a positive adjusted company EBIT for full-year 2020.

Zacks Rank & Other Stocks to Consider

Ford currently flaunts a Zacks Rank #1 (Strong Buy). Shares of the company have depreciated 17.2%, year to date, underperforming the industry’s rise of 139%.

Some other top-ranked stocks in the auto sector are Lear Corporation LEA, Autoliv Inc ALV and LCI Industries LCII all of which sport a Zacks Rank of 1, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Autoliv, Inc. (ALV) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

LCI Industries (LCII) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research