Fed's Bullard to AFP: US interest rates 'in right neighborhood'

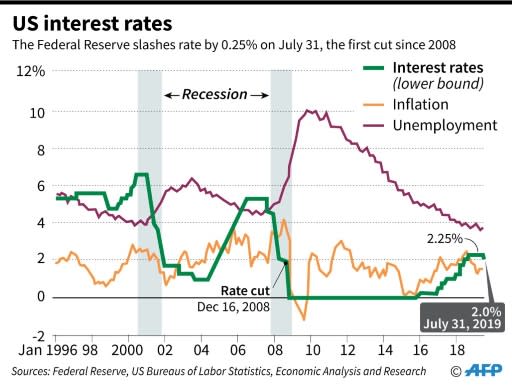

US interest rates now are "in the right neighborhood," James Bullard, a key member of the central bank policy board, told AFP on Tuesday, seeming to wave off expectations of another cut soon, despite the relentless pressure President Donald Trump. After cutting the benchmark interest rate last week for the first time in a decade, policymakers have "already done quite a bit" to help deal with the uncertainty surrounding trade wars, Bullard said in an interview, and now will watch how the economy reacts before deciding its next move. Bullard was the first Fed official to call for the central bank to roll back some of the four rate increases adopted last year, something Trump has been demanding almost daily in a constant stream of tweets. But, in the interview, Bullard did not seem to see an urgent need to move further immediately. Trump also has demanded the Fed respond to China's moves in the trade war, including allowing its currency to weaken against the dollar. "China dropped the price of their currency to an almost a historic low. It's called 'currency manipulation.' Are you listening Federal Reserve? This is a major violation which will greatly weaken China over time!" Trump said Monday on Twitter. But, in the first public comments from a top Fed official since Monday's deterioration in US-China relations, Bullard said "we can't realistically move monetary policy in a tit-for-tat trade war." "That would be too volatile," said Bullard, president of St Louis Federal Reserve Bank. "We've already taken into account that there's going to be a lot of uncertainty on the trade policy dimension and that's why we've had this sea change in monetary policy over the previous six months." In a speech delivered on Tuesday, Bullard said he expected the stormy crosscurrents from the trade war to persist. "I do not expect this uncertainty to dissipate in the quarters and years ahead," he said in prepared remarks. And like Fed Chair Jerome Powell, Bullard brushed off Trump's attacks on the central bank. "We're making decisions the way we always have," he told AFP, noting that many Fed leaders have faced political pressure because president's always think lower interest rates are better for them. The four living former Fed chairs signed an op-ed in The Wall Street Journal published Monday warning of the dangers of political interference in central bank policy and saying they could undermine the credibility of the decisions. - Waving off rate cut expectations - Bullard says he has "penciled in" another rate cut for this year but it was significant that the Fed's biggest policy "dove" seemed to want to deflate market expectations for the Fed to move at September's meeting. "We're certainly in the right neighborhood. Whether we should do a little more or not will depend on incoming data," he said. He wants to see how the economy and inflation perform "in the fall" after the significant policy shift the Fed already made, which can take six months to show up in economic data. "I do want to take stock about how the accommodation we've put in place has had an impact," he said. However, Trump's hardline trade advisor Peter Navarro said the Fed moved "too far, too fast" with increases last year that cost the economy growth and jobs, and should cut rates by up to a full percentage point this year. Bullard though told said the economy continues to grow above trend and compared the current situation to past economic expansions where the Fed has raised rates several times and then taken back a few steps. "We're trying find the right level," he said, although inflation is still in danger of being too far below the Fed's two percent target which he said "a concern." Some central bankers -- including two who opposed last week's rate cut -- are concerned that cutting rates may cause inflation to spike and prompt risky behavior in financial markets but Bullard downplayed the concerns. "I don't see anything right now that gives me enough pause to put heavy weight on that argument," he said, noting that he is still "sensitive to it" since those risks can erupt without warning. Federal Reserve Bank President James Bullard speaks during an interview with AFP Chart showing US Federal interest rates, inflation and unemployment rates since 1996. Federal Reserve Bank President James Bullard tells AFP the central bank already has done 'quite a bit' to adjust to uncertainty caused by trade wars