Federal Budget 2020: What it means for you

For more Yahoo Finance stories on the 2020 Federal Budget, visit here.

Treasurer Josh Frydenberg has unveiled what was touted to be the most critical Federal Budget in history.

The policy measures outlined in today’s Federal Budget are what the Coalition Government believes will pull our nation out of its first recession in nearly 30 years.

But the nation is now facing a $214 billion deficit, the highest deficit since World War II.

It follows a once-in-a-century pandemic that saw 1 million Australians lose their jobs at the height of the unemployment crisis, 900,000 businesses turn to Government assistance, millions raid their superannuation and a rollercoaster ride on the stock market.

Whatever your situation is, this Budget is going to impact your everyday life in one way or another. Yahoo Finance has broken down exactly what the 2020 Federal Budget means for you.

Also read: Budget 2020: Winners and losers

Also read: Budget 2020: Who is getting a job from the Federal Budget?

If you’re a taxpayer…

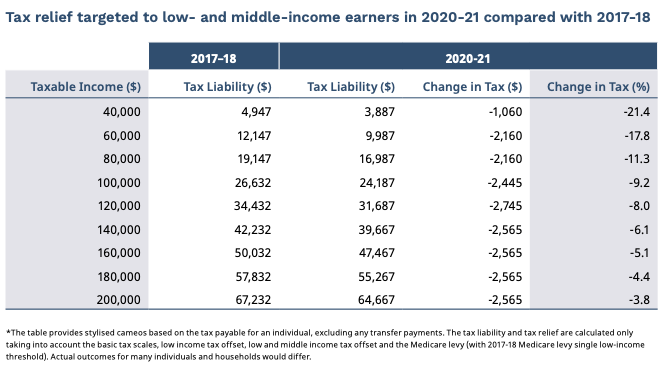

Millions of Australians will receive a tax break this year, with the Government fast-tracking stage two of its income tax cuts.

The cuts were originally scheduled for July 2022, and would see the 19 per cent tax threshold increased from $41,000 to $45,000 and the 32.5 per cent threshold go from $90,000 to $120,000.

Here’s a break down of the tax cuts:

If you earn up to $40,000, you’ll save up to $1,060

If you earn more than $40,000, up to $80,000, you’ll save up to $$2,160

If you earn more than $80,000, up to $100,000, you’ll save up to $2,445

If you earn more than $100,000, up to $120,000, you’ll save up to $2,745

If you earn more than $120,000, up to $200,000, you’ll save up to $2,565

There will also be a one-off additional benefit from the low-and middle-income tax offset in 2020-21.

The tax cuts will be backdated to 1 July this year. Here’s more on the tax cuts.

If you’re a tradie…

Since the Covid-19 pandemic hit, the government has invested an extra $14 billion in new and current infrastructure projects over the next four years.

It’s part of the government’s 10-year infrastructure pipeline, which has grown to $110 billion.

Tradie wages will be supported by the Government, as part of a $1.2 billion plan to encourage businesses to make new hires.

Under the plan, the Government will pay half the wages of 100,000 apprentices or trainee workers, with employers able to receive up to $7,000 per quarter until that 100,000 limit is exhausted.

The plan is an extension of the Supporting Apprentices and Trainees scheme, which only allowed for apprentices who were training as of 1 July this year.

If you’re under 35 and unemployed…

Around 450,000 Australians aged 16 to 35 will benefit from the JobMaker Hiring Credit.

The scheme will be available to employers from 7 October 2020 for each new job they create over the next 12 months for which they hire an eligible young person.

For each eligible employee, employers will receive for up to 12 months:

$200 per week if they hire a young person aged 16 to 29; or

$100 per week if they hire a young person aged 30 to 35.

Young job seekers will have received JobSeeker, Youth Allowance or a Parenting Payment for at least one of the previous three months at the time of hiring.

If you’re a small business…

A temporary tax incentive will be introduced for 3.5 million businesses (99 per cent) for around $200 billion worth of investment.

It means businesses with turnover of up to $5 billion can deduct the full cost of eligible depreciable assets in the year they’re installed, as well as any improvements to existing eligible depreciable assets. This will apply from today until 30 June 2022.

Small businesses can also create a tax refund for themselves by offsetting losses against previous profits that have already been taxed.

This will be available to a million companies which employ nearly 9 million workers. It means losses up to the 2021-22 financial year can be carried back against profits made in or after 2018-19.

The Morrison Government has also committed $1.67 billion to cybersecurity, $4.5 billion to NBN and a further $800 million on a range of programs in infrastructure and security to help businesses engage in the digital world.

The scheme will mean businesses get a “digital identity”, enabling them to have “a seamless interface with government and e-invoicing, making that a key part of ensuring we pay businesses quicker and on time,” the Prime Minister said.

The Government is also ‘cutting red tape’ by paring back and streamlining regulatory processes and getting rid of unnecessary costs.

If you’re a welfare recipient…

Aged care, family and disability welfare recipients will receive a $500 cash boost from the Government, with one $250 payment arriving in December and another in March 2021.

The support measures will cost $2.6 billion for the two payments, and are in addition to the $9.4 billion in support provided through the two previous $750 previous support payments distributed earlier this year.

If you’re a pensioner...

You’ll also receive two $250 payments under the above scheme.

If you’re on JobSeeker...

The Coronavirus Supplement boosting the JobSeeker payment has been reduced from $550 to $250 a fortnight. That means the JobSeeker rate has been reduced to $815 per fortnight as of September 25.

The assets test, which was waived when Covid-19 first hit, has been re-introduced, meaning Aussies with more than $5,500 in their savings will be forced to wait 13 weeks for their JobSeeker payment. It also means a huge chunk of Aussies will be kicked off the welfare payment entirely.

If you’re on JobKeeper...

JobKeeper has been officially extended to 28 March, 2021 with the extension coming in two phases.

The first phase began on 28 September, and would see those working more than 20 hours per week receive $1,200 per fortnight. That’s around 80 per cent of the minimum wage.

Those who work less than 20 hours per week will receive $750 per fortnight.

From 4 January, the second phase will be introduced.

That phase will see those working more than 20 hours per week receive $1,000 per fortnight, and those working less than 20 hours per week pocket $650 per fortnight.

If you drive to work…

The Government has unveiled a $7.5 billion investment into national transport infrastructure, which is touted to create thousands of new jobs.

This is in addition to the Government’s existing $100 billion infrastructure pipeline.

"These projects will keep commuters safe on the road, get people home to their loved ones sooner and provide better transport links for urban and regional communities,” Prime Minister Scott Morrison said of the projects.

Here’s more on the infrastructure projects.

If you’re a parent…

Parents of stillborn babies, or whose babies die within 12 months will benefit from a $7.6 million government support package.

The change means parents will receive $3,606 in support payments to help deal with the personal and financial damage of a stillbirth.

If you’re in the health industry…

Telehealth and e-prescription services have been extended, and the Government has committed to extra funding for aged care in the wake of the Royal Commission.

Morrison has also committed $9 million to research into cancer in children and young adults.

The Government is also investing $4.9 billion for a range of health measures ensuring Australians continues to receive support throughout Covid-19.

That includes $3.2 billion in personal protective equipment and $1.1 billion towards states and territories through the National Partnership Agreement on Covid-19 response.

If you live in regional Australia…

Bushfire and coronavirus-ravaged parts of regional Australia will receive a share of the Government’s $100 million Regional Recovery Fund over the next two years.

The program will be targeted at regions suffering after drought, bushfires and the pandemic, as well as areas primed for economic diversification.

In NSW, the Snowy Mountains, Hunter-Newcastle and Parkes regions will be eligible.

Victoria's Gippsland region is included, along with Cairns, Gladstone, Mackay-Isaac-Whitsunday and the tropical north in Queensland.

All of Tasmania, South Australia's Kangaroo Island and Western Australia's South West are also covered.

If you have liver cancer…

The Government has committed $230 million to a new combination treatment for HCC, a deadly form of liver cancer.

The cancer has limited treatment options and has one of the lowest survival rates of all cancer types.

The commitment would expand the Tecentriq and Avastin listing on the Pharmaceutical Benefits Scheme.

From 1 November, more than 500 patients a year would benefit from the listing of the treatment, which otherwise costs upwards of $170,000 per course.

If you’re a first home buyer…

An extra 10,000 people will be able to access a loan to build a home or buy a newly built house with a deposit of 5 per cent.

This is expected to generate an extra $800 million in economic activity.

If you’re a young Australian…

The Government is investing $146 million in a range of programs to improve the educational outcomes of disadvantaged students and school leavers.

This is in addition to the Government’s $21.8 billion spend on school funding in 2020, and will grow to $34 billion by 2030.

The Government is also providing opportunities for students and recently unemployed Australians to retrain in areas of high demand via 50,000 higher education short courses.

It’s also investing a further $299 million to provide an additional 12,000 undergraduate university places in 2021.

If you’re a woman...

The Government will funnel $240.4 million into the 2020 Women’s Economic Security Statement, with a goal of increasing women’s workforce participation and earnings potential.

This includes funding to support women’s leadership and development and to increase opportunities for women in science, technology, engineering and mathematics sectors.

However, women suffered more than 50 per cent of the coronavirus job losses, and across the 14 sectors hardest hit by the coronavirus pandemic, women lost more jobs than men in 14.

If you use Medicare…

$112 million has been pledged to continue Medicare-rebated telehealth services that were set up during the pandemic for GP, allied health and specialist consultations.

If you need aged care...

$1.6 billion has been provided to protect older Aussies in aged care. The budget is allowing for another $746.3 million for senior Aussies, workers and providers which includes $245 in Covid-19 support payments and $205.1 million for the Workforce Retention Bonus payments for aged care workers on the frontline.

If you care about the environment…

The Government is banning the export of waste plastic, paper, tyres and glass in a bid to stop 645,000 tonnes of waste ending up in landfill each year.

The Government will invest $249.6 million over four years to modernise recycling infrastructure, reduce waste and recycle more within Australia. That includes a $190 million Recycling Modernisation Fund which will invest in new infrastructure to sort and recycle plastic.

If you need mental health care…

More than $148 million has been pledged for mental health support. Every Aussie will be able to access 10 extra Medicare-rebated psychology sessions, and headspace, Lifeline, Kids Helpline and Beyond Blue also get extra funding.

If you have superannuation…

The early access super scheme is available again this financial year – so if your finances have been hit by Covid-19, you can access another $10,000 of your super. This is available until 31 December this year.

You’ll also save on pesky superannuation fees: now, when you change jobs, you’ll actually keep your old superfund, which helps prevent the creation of multiple accounts.

Super funds will also be forced to perform strongly, or else: they’ll have to meet an annual performance test. If they fail, they’ll have to tell their members, and give them the option to move their members to a different fund.

If they continue to underperform, they won’t be allowed to accept new members until performance improves.

Transparency and accountability will also be improved, so members’ retirement money is only spent on “activities that are in their best financial interests”.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.