COVID-19 leaves unbanked minority communities behind on savings, credit

The disparate impact of the COVID-19 crisis on low-income, minority communities will likely exacerbate their ability to build savings and get access to credit, according to a new survey from the Federal Deposit Insurance Corporation released Monday.

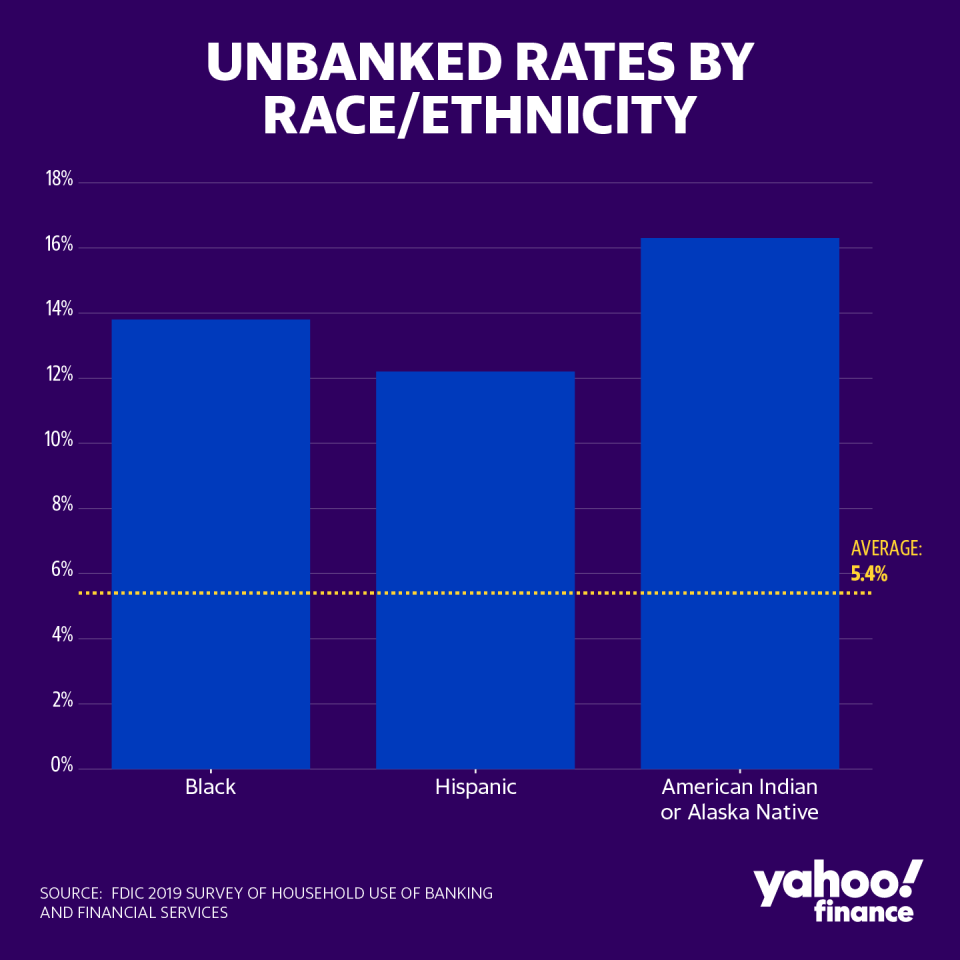

The FDIC’s Survey of Household Use of Banking and Financial Services noted that before the pandemic, only 5.4% of U.S. households did not have a bank or credit union account. But a far higher share of Black and Hispanic households are unbanked, at 13.8% and 12.2%, respectively. American Indian or Alaska Native communities had the highest rates of unbanked households, at 16.3%.

With no bank account, millions of households had to wait weeks, even months, for stimulus checks to hit their mailboxes from the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Since lower-income households also have a higher likelihood of being unbanked, these were likely the households that needed the checks the most.

“The economic ramifications of the COVID-19 pandemic may particularly affect households without an adequate savings cushion or without access to responsible, affordable credit,” the report reads.

The FDIC insures deposits at member banks up to $250,000 per account, and has advocated for the 7.1 million unbanked households to open accounts.

The banking agency has warned that having no banking account makes it difficult to build a credit record, pushing borrowers into expensive alternative financing options like pawn shops or payday loans.

The FDIC data shows that unbanked rates across-the-board had declined between 2011 and 2019, but noted that job losses in the COVID-19 crisis will likely reverse those improvements and lead to an increase in the share of households that are unbanked.

The same study in 2013 found that one-in-three households (34.1%) that became unbanked in the year prior either suffered a significant pay cut or lost their job entirely.

With the virus affecting minority communities at a disproportionate rate, layoffs in Black, Hispanic, and American Indian communities may correspond with losing bank accounts as well. Nearly 36% of households lack the savings to cover an unexpected expense, meaning that the pandemic is likely to have wiped out any savings at the bank.

The FDIC noted that in 2019, the number one reason cited for not having a bank account was not having enough money to meet minimum balance requirements.

The FDIC survey, formerly known as the National Survey of Unbanked and Underbanked Households, was conducted in June 2019 and covered about 59,000 U.S. households.

Brian Cheung is a reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz.

Powell: Fed open to private sector collaboration in possible digital dollar

Big banks are cautiously optimistic about the economic recovery

IMF projects less severe global recession in 2020, but 'uneven' recovery

Less-educated Asian Americans among hardest hit by job losses during pandemic

A glossary of the Federal Reserve's full arsenal of 'bazookas'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.