FactSet (FDS) Surpasses Q4 Earnings and Revenue Estimates

FactSet Research Systems Inc. FDS reported strong fourth-quarter fiscal 2020 results, wherein earnings and revenues topped the Zacks Consensus Estimate. The stock has not moved much since the quarterly results.

The company reported adjusted earnings per share of $2.88, which surpassed the Zacks Consensus Estimate by 13.4% and increased 10.3% on a year-over-year basis, driven by lower tax rate and higher operating efficiency.

FactSet’s revenues of $383.6 million surpassed the Zacks Consensus Estimate by 1.4% and increased 5.3% year over year. The uptick was driven by higher sales of analytics, content and technology solutions, and wealth-management solutions.

Notably, FactSet’s shares have gained 22.4% year to date against 4.6% decline of the industry it belongs to.

Revenues in Detail

Organic revenues increased 4.9% year over year to $383.4 million. Region-wise, U.S. revenues increased to $234.4 million from $222.1 million in the year-ago quarter. EMEA revenues were $113.8 million compared with $108.9 million in the year-ago quarter. Asia Pacific revenues were $35.4 million compared with $33.3 million in the year-ago quarter.

ASV Plus Professional Services

FactSet’s Annual Subscription Value (“ASV”) plus professional services was $1.6 billion, up 5.3% organically. Buy-side and sell-side ASV growth rates were 5.4% and 4.6%, respectively. Nearly 84% of organic ASV was generated by buy-side and the rest by sell-side firms performing functions like mergers and acquisitions-advisory work, equity research and capital-markets services.

ASV generated from the United States was $956.6 million, up 5.2% from the prior-year quarter. ASV from EMEA and Asia Pacific regions were $426 million and 156.5 million, up 5.7% and 7.6% year over year, respectively. FactSet added 132 clients in the reported quarter, taking the total to 5,875. Annual client retention was 90%. At the end of the quarter, total employee count was 10,484, up 8.3% year over year.

Operating Results

Adjusted operating income came in at $127.4 million, up 2.8% from the year-ago quarter’s figure. Adjusted operating margin decreased to 33.2% from 33.9% in the year-ago quarter. Selling, general and administration expenses increased 19.4% to $101.4 million. Total operating expenses increased 12.8% to $285 million.

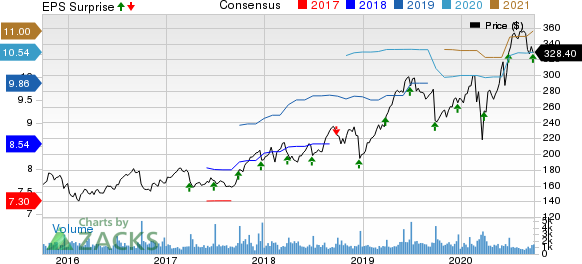

FactSet Research Systems Inc. Price, Consensus and EPS Surprise

FactSet Research Systems Inc. price-consensus-eps-surprise-chart | FactSet Research Systems Inc. Quote

Balance Sheet and Cash Flow

FactSet exited fourth-quarter fiscal 2020 with cash and cash equivalents of $585.6 million compared with $457.7 million in the previous quarter. Long-term debt of $574.3 million was flat with the prior-quarter figure. In the quarter, the company generated $159.4 million of cash from operating activities while capital expenditure was $14.7 million. Free cash flow was $144.7 million.

Fiscal 2021 Outlook

The company anticipates adjusted EPS in the range of $10.75-$11.15, the midpoint ($10.95) of which is lesser than the Zacks Consensus Estimate of $11.

The company expects revenues between $1.57 billion and $1.585 billion, higher than the Zacks Consensus Estimate of $1.56 billion.

Organic ASV plus professional services for fiscal 2021 is projected to increase in the range of $55-$85 million over fiscal 2020. Adjusted operating margin is projected in the range of 32%-33%. The annual effective tax rate is expected between 15% and 16.5%.

FactSet currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Investors interested in the broader Zacks Business Services sector are keenly awaiting third-quarter 2020 earnings reports of key players like Waste Connections WCN, Waste Management WM and Republic Services RSG. While Waste Connections will release earnings on Oct 28, Waste Management and Republic Services will report the same on Nov 2 and Nov 5, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

FactSet Research Systems Inc. (FDS) : Free Stock Analysis Report

Waste Connections, Inc. (WCN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research