EUR/USD Mid-Session Technical Analysis for February 21, 2020

The Euro is trading higher against the U.S. Dollar on Friday, helped by better than expected Euro Zone economic data. Traders are now awaiting the release of the U.S. Flash Manufacturing report at 14:45 GMT. Traders are looking for a reading of 51.5, slightly below the previously reported 51.9. Flash Services PMI is expected to come in at 53.3, unchanged. Both reports could move the market.

At 14:23 GMT, the EUR/USD is trading 1.0807, up 0.0024 or +0.22%.

In other news, CNBC reported that leaders of the 27 EU member states failed to make any headway in budget talks on Thursday. The U.K.’s departure from the bloc last month is projected to leave a £55 billion ($71.3 billion) hole in the EU’s coffers over the next seven years.

Business activity in the Euro Zone accelerated more than expected this month, a business survey showed on Friday, in welcome news for policymakers at the European Central Bank who are battling to revive growth and chronically low inflation.

IHS Markit’s Euro Zone Composite Flash Purchasing Manager’s Index (PMI), seen as a good gauge of economic health, rose to 51.6 in February from January’s final reading of 51.3, beating all forecasts in a Reuters poll which had a median prediction of 51.0. Anything above 50 indicates growth.

“The Euro Zone economy managed to pick up some momentum again in February despite many companies having been disrupted in various ways by the coronavirus, which caused supply problems,” said Chris Williamson, chief business economist at IHS Markit.

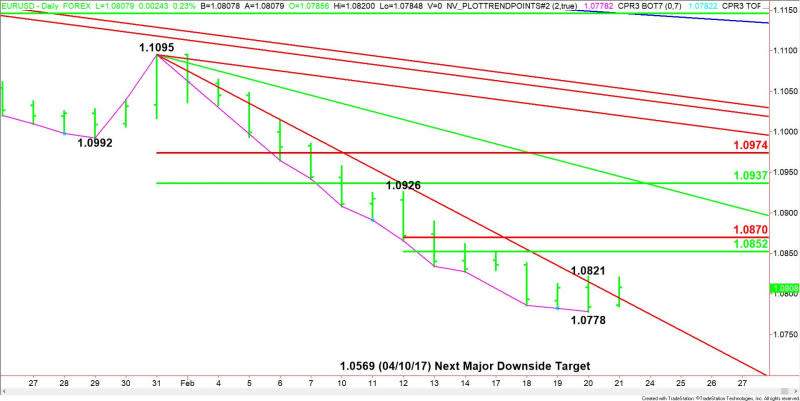

Daily Technical Analysis

The main trend is down according to the daily swing chart. A trade through 1.0778 will signal a resumption of the downtrend. The main trend will change to up on a move through the last main top at 1.1095.

The minor trend is down according to the daily swing chart. A trade through 1.0821 will change the minor trend to up. This will also shift momentum to the upside.

The minor range is 1.0926 to 1.0778. Its retracement zone at 1.0852 to 1.0870 is the first upside target.

Daily Technical Forecast

Based on the early price action and the current price at 1.0807, the direction of the EUR/USD the rest of the session on Friday is likely to be determined by trader reaction to the downtrending Gann angle at 1.0795.

Bullish Scenario

A sustained move over 1.0795 will indicate the presence of buyers. The first upside target is the minor top at 1.0821. Taking out this level will change the minor trend to up. This could create the upside momentum needed to challenge the short-term retracement zone at 1.0852 to 1.0870.

Bearish Scenario

A sustained move under 1.0795 will signal the presence of sellers. This could lead to a retest of yesterday’s low at 1.0778. Taking out this level could trigger an acceleration to the downside.

This article was originally posted on FX Empire

More From FXEMPIRE:

Crude Oil Weekly Price Forecast – Crude Oil Markets Looking to Recover

Natural Gas Weekly Price Forecast – Natural Gas Markets Show Signs of Resistance

S&P 500 Price Forecast – Stock Markets Pullback to Look For Buyers

GBP/JPY Weekly Price Forecast – British Pound Trying to Break Out Against Japanese Yen

NZD/USD Forex Technical Analysis – Close Over .6332 Forms Closing Price Reversal Bottom

Natural Gas Price Forecast – Natural Gas Markets Looking For Range