If You Like EPS Growth Then Check Out North American Construction Group (TSE:NOA) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in North American Construction Group (TSE:NOA). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for North American Construction Group

North American Construction Group's Improving Profits

Over the last three years, North American Construction Group has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, North American Construction Group's EPS shot from CA$1.01 to CA$1.82, over the last year. You don't see 81% year-on-year growth like that, very often.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that North American Construction Group is growing revenues, and EBIT margins improved by 4.3 percentage points to 12%, over the last year. That's great to see, on both counts.

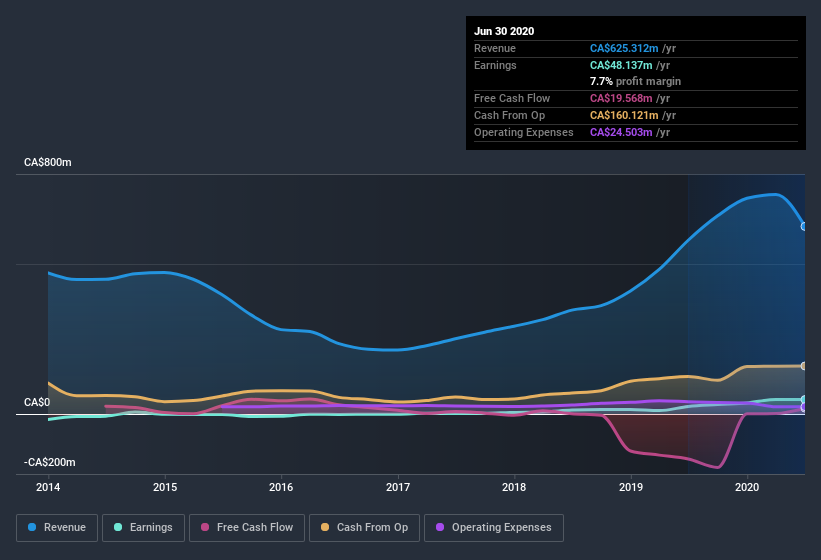

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for North American Construction Group.

Are North American Construction Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see North American Construction Group insiders walking the walk, by spending CA$483k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the Chairman & CEO, Martin Ferron, who made the biggest single acquisition, paying CA$315k for shares at about CA$13.34 each.

The good news, alongside the insider buying, for North American Construction Group bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold CA$24m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 9.7% of the company, demonstrating a degree of high-level alignment with shareholders.

Does North American Construction Group Deserve A Spot On Your Watchlist?

North American Construction Group's earnings have taken off like any random crypto-currency did, back in 2017. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest North American Construction Group belongs on the top of your watchlist. However, before you get too excited we've discovered 4 warning signs for North American Construction Group (1 doesn't sit too well with us!) that you should be aware of.

The good news is that North American Construction Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.