With EPS Growth And More, HiTech Group Australia (ASX:HIT) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like HiTech Group Australia (ASX:HIT), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for HiTech Group Australia

HiTech Group Australia's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. HiTech Group Australia boosted its trailing twelve month EPS from AU$0.073 to AU$0.081, in the last year. That's a 11% gain; respectable growth in the broader scheme of things.

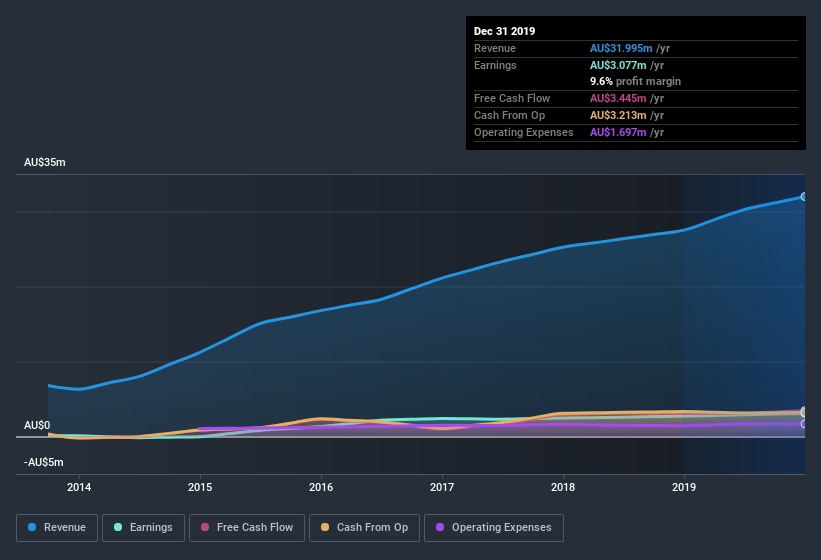

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note HiTech Group Australia's EBIT margins were flat over the last year, revenue grew by a solid 16% to AU$32m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since HiTech Group Australia is no giant, with a market capitalization of AU$54m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are HiTech Group Australia Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that HiTech Group Australia insiders own a significant number of shares certainly appeals to me. In fact, they own 75% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about AU$40m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Does HiTech Group Australia Deserve A Spot On Your Watchlist?

One important encouraging feature of HiTech Group Australia is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. You should always think about risks though. Case in point, we've spotted 2 warning signs for HiTech Group Australia you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.