Revealed: Aussies spend early access super on gambling, beauty products

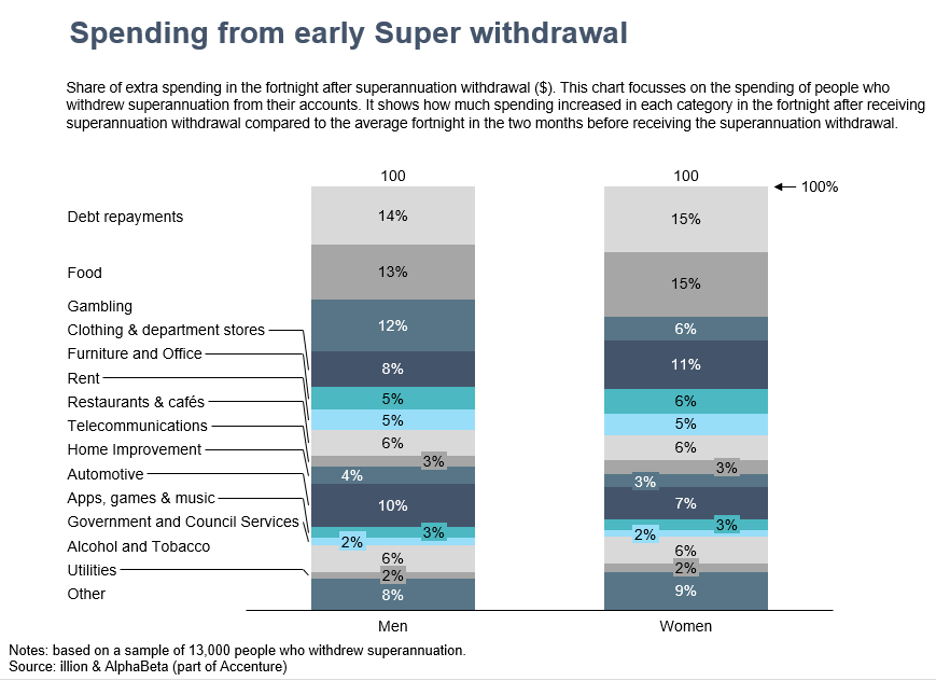

Women who are accessing their super early are more likely to spend it on essential purchases for the family, whereas men are more likely to spend it on nice-to-haves, with gambling skyrocketing, new data has revealed.

According to data by illion and AlphaBeta, women are spending more than men on food, clothing and household bills, but also on personal care such as hair and beauty.

On the other hand, men are outspending women on discretionary items like entertainment, automotives and gambling, with the latter expenditure 93 per cent higher than women.

According to AlphaBeta director Andrew Charlton, the data indicates that the early access super policy is not achieving its objective – and Australians will be the ones who end up paying the price.

“The high levels of discretionary spending from people who accessed their superannuation early further demonstrates that this money was used to increase spending – as opposed to being the lifeline for which it was intended,” he asid.

“While this spending would have certainly helped the economy – in similar ways to JobKeeper and JobSeeker – there will be heftier prices to pay in retirement with the early withdrawal of super.”

Illion CEO Simon Bligh said that the money spent on non-essentials warrants a rethink of the scheme before the next up-coming release date of 1 July.

“More than half of the early superannuation spending was on discretionary items. Each dollar in super is worth up to 10 times the value now at retirement age,” he said.

“We would strongly encourage people to think about this value equation before they withdraw and spend.”

Is the early access scheme a good idea?

The scheme has attracted plenty of criticism, with many arguing that the early withdrawals can leave a significant dent in nest eggs come retirement time.

“Obviously there are people who are in a position and they have been let go from their jobs and they can’t put food on the table who just need the money,” said Apt Wealth financial planner Emily Lanciana.

But accessing $10,000 now could mean forgoing $100,000 in a decade, she added.

“There is also other government support out there and, I would stress, if you do access your super, then have a plan to top it back up when you can afford to.”

Industry Super Australia chief executive Bernie Dean and money expert Nicole Pedersen-McKinnon also advise caution before proceeding.

“Members should tread carefully and only think about cracking open their super after they’ve taken up the extra cash support on offer from the government – super should be the last resort given the impact it can have on your retirement nest egg,” said Dean.

Pedersen-McKinnon said: “Modelling shows a $20,000 withdrawal in your twenties becomes $80,000 less in your fund at retirement. And right now, you may well be selling at an historic low.”

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.