‘Digital gold’: Is bitcoin ‘the ultimate hedge’ during a recession?

Australia is officially in its first recession in nearly 30 years, and while the traditional safe haven during economic downturns is gold, some industry experts believe bitcoin can also provide that same market safety.

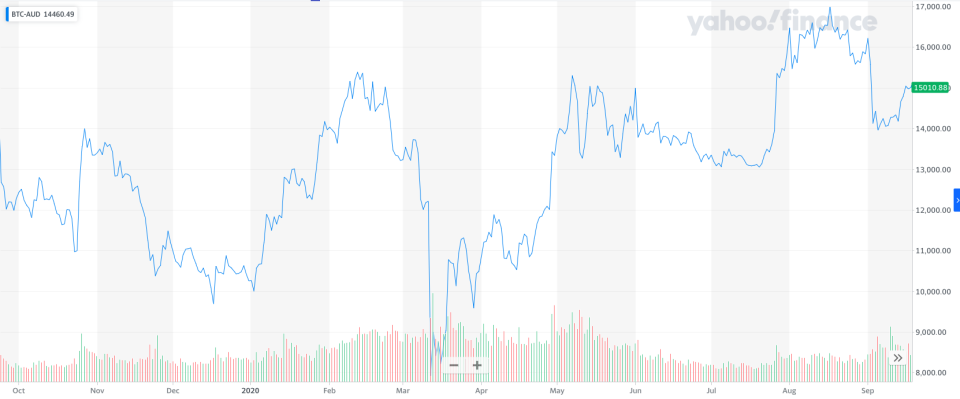

One bitcoin is currently worth $14,469 (9:44am AEST), and there are only 21 million bitcoins in the entire world.

It’s been dubbed ‘digital gold’ because it can’t be created; it needs to be ‘mined’, or unlocked. So far, 18.5 million bitcoin have been mined, which leaves less than three million left to be introduced into circulation.

But unlike gold, the stash will never be replenished. Once all the bitcoins on the internet have been mined, the supply will be exhausted. It’s predicted to take more than 100 years before the last ever bitcoin is mined.

It’s for this reason that Jonathon Miller, the managing director of bitcoin exchange Kraken, believes bitcoin could be safer than gold during times of market distress.

“We talk about crypto, especially bitcoin, as being the ultimate hedge in the long run,” Miller told Yahoo Finance.

“There will only ever be 21 million bitcoins, so there will always be a limited supply. And the internet isn’t going anywhere. So, as far as digital money goes, and a native currency to the internet, it’s very hard to argue that bitcoin and other cryptocurrencies are going to go away.”

And while Miller admits bitcoin lives in a “speculative arena”, he says it has the tightest correlation to gold that it’s ever had.

“Crypto is considered a non-correlated asset, so that means when you have times of uncertainty and volatility, like you’ve seen in the stock market and the property market recently, you will see crypto doing the opposite,” he said.

But I thought bitcoin meant risky business?

Though it’s been around for more than a decade, bitcoin is a relatively new market, and it is still high risk, Miller said.

“It’s a speculative market, so people often come out and make statements about what bitcoin can do in the future, and that creates a lot of volatility.”

There are also the major security risks associated with something that relies so heavily on technology, and many punters have been duped out of their bitcoins in fraudulent transactions.

“There are a lot of cryptocurrency brands and businesses out there that have more of a cowboy style persona,” Miller said.

Kraken operates differently, and has been rated as the most transparent and secure crypto exchange in the world. “We have a fantastic track record. And the thing about cryptocurrencies is because it's digital, it's something that takes a little while to get your head around, so we provide a lot of educated resources, but also a really secure platform.”

In fact, Kraken has former FBI agents working in its compliance team, and the ex-treasurer of PayPal working as the company’s treasurer.

“They are bringing that degree of professionalism to the industry.”

What should I know if I want to invest in cryptocurrency?

The first thing to note is, when it comes to crypto and bitcoin, it’s important to deal with a super secure provider, Miller said.

The second thing you need to know is, like any form of investing, delve into the risks associated with this type of asset, and make decisions accordingly.

“We’re not financial advisers, but we do always urge you to be wary, as you would with any investment,” Miller said.

Are you a millennial or Gen Z-er interested in joining a community where you can learn how to take control of your money? Join us at The Broke Millennials Club on Facebook!