Did You Miss Kangaroo Island Plantation Timbers's (ASX:KPT) Impressive 122% Share Price Gain?

Kangaroo Island Plantation Timbers Limited (ASX:KPT) shareholders might understandably be very concerned that the share price has dropped 60% in the last quarter. But that scarcely detracts from the really solid long term returns generated by the company over five years. Indeed, the share price is up an impressive 122% in that time. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Of course, that doesn't necessarily mean it's cheap now.

View our latest analysis for Kangaroo Island Plantation Timbers

We don't think Kangaroo Island Plantation Timbers's revenue of AU$212,000 is enough to establish significant demand. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. Investors will be hoping that Kangaroo Island Plantation Timbers can make progress and gain better traction for the business, before it runs low on cash.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Kangaroo Island Plantation Timbers has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

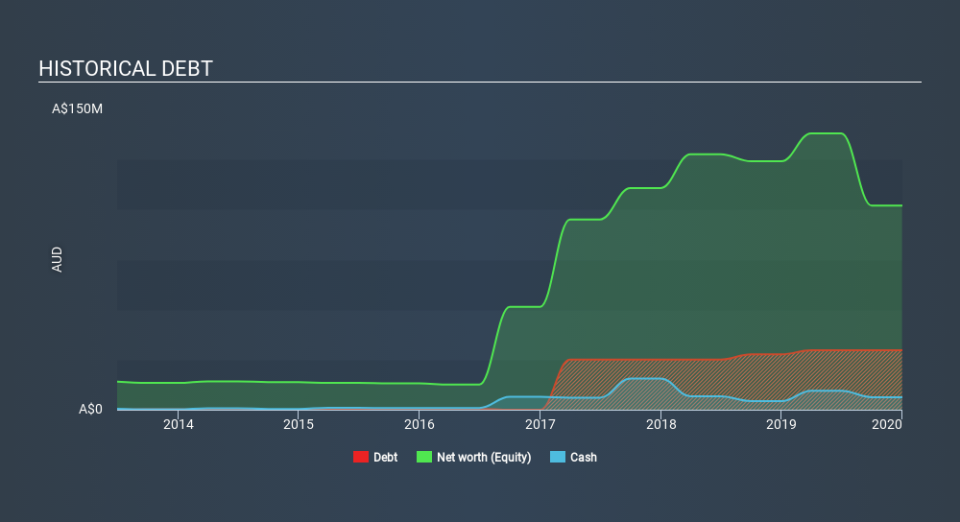

Kangaroo Island Plantation Timbers had liabilities exceeding cash by AU$48m when it last reported in December 2019, according to our data. That puts it in the highest risk category, according to our analysis. So we're surprised to see the stock up 92% per year, over 5 years , but we're happy for holders. It's clear more than a few people believe in the potential. The image below shows how Kangaroo Island Plantation Timbers's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, many of the best investors like to check if insiders have been buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Kangaroo Island Plantation Timbers's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Kangaroo Island Plantation Timbers's TSR, at 138% is higher than its share price return of 122%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While the broader market lost about 15% in the twelve months, Kangaroo Island Plantation Timbers shareholders did even worse, losing 55%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 19%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Kangaroo Island Plantation Timbers better, we need to consider many other factors. Case in point: We've spotted 5 warning signs for Kangaroo Island Plantation Timbers you should be aware of, and 3 of them are a bit unpleasant.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.